Qualcomm Share Price: Trends and Insights

Introduction

Qualcomm, a leading player in the semiconductor and telecommunications industry, has been a significant force in the tech market. Understanding the Qualcomm share price is crucial for investors, market analysts, and tech enthusiasts alike, as it directly reflects the company’s performance, innovations, and industry positioning. With the rise of 5G technology and increasing demand for mobile devices, Qualcomm’s share price has come under close scrutiny.

Current Trends in Qualcomm Share Price

As of October 2023, Qualcomm’s share price has experienced a range of fluctuations. Recently, the stock was valued at approximately $130 per share, down from its price of around $150 earlier this year due to various market pressures. Factors influencing this decline include global semiconductor shortages, increased competition, and changing market dynamics in the telecommunications sector.

Factors Affecting the Qualcomm Share Price

Several key factors contribute to the volatility of Qualcomm’s share price:

- Industry Trends: The shift towards 5G technology has both bolstered and challenged Qualcomm’s market position. While there is a growing demand for 5G-capable devices, regulatory and competitive pressures have impacted revenue.

- Financial Performance: Qualcomm recently reported mixed quarterly earnings, which fell short of analyst expectations. This has influenced investor sentiment and contributed to the downturn in share price.

- Market Sentiment: Global economic conditions, including inflation and interest rate changes, are ongoing concerns that affect investor confidence in tech stocks like Qualcomm.

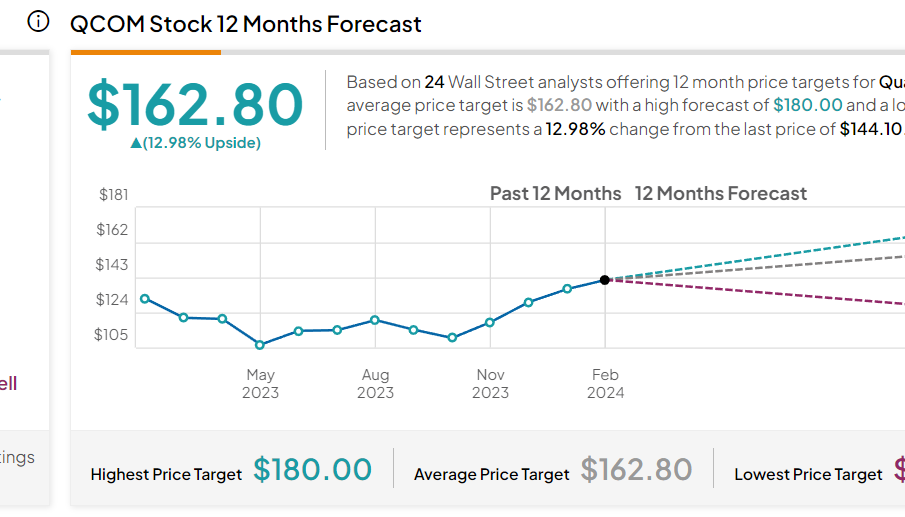

Looking Ahead: Forecast for Qualcomm Share Price

Market analysts remain cautiously optimistic about the resilience of Qualcomm’s stock. Projections suggest that if the company successfully navigates the current economic climate and continues to innovate in 5G technology, its share price could recover and move upward in the coming quarters. By investing heavily in research and development, Qualcomm aims to maintain its competitive edge in the dynamic tech landscape.

Conclusion

For investors, staying informed about Qualcomm’s share price and the factors influencing it is essential for making sound investment decisions. The tech industry is notoriously volatile, and while Qualcomm’s current position may appear wobbly, the potential for long-term growth is significant. As tech reliance continues to grow globally, Qualcomm’s innovations in semiconductor technology will likely play a pivotal role in not only their recovery but also in the overall tech sector’s evolution.