Latest Trends in Dr Reddy’s Share Price

Introduction

Dr Reddy’s Laboratories, a key player in the Indian pharmaceutical industry, has been the center of attention for investors and analysts alike. Understanding the fluctuations in Dr Reddy’s share price is crucial for investors looking to make informed decisions. As the pharmaceutical sector is heavily influenced by regulatory changes, drug approvals, and market dynamics, keeping a pulse on Dr Reddy’s share price can provide insights into broader market trends.

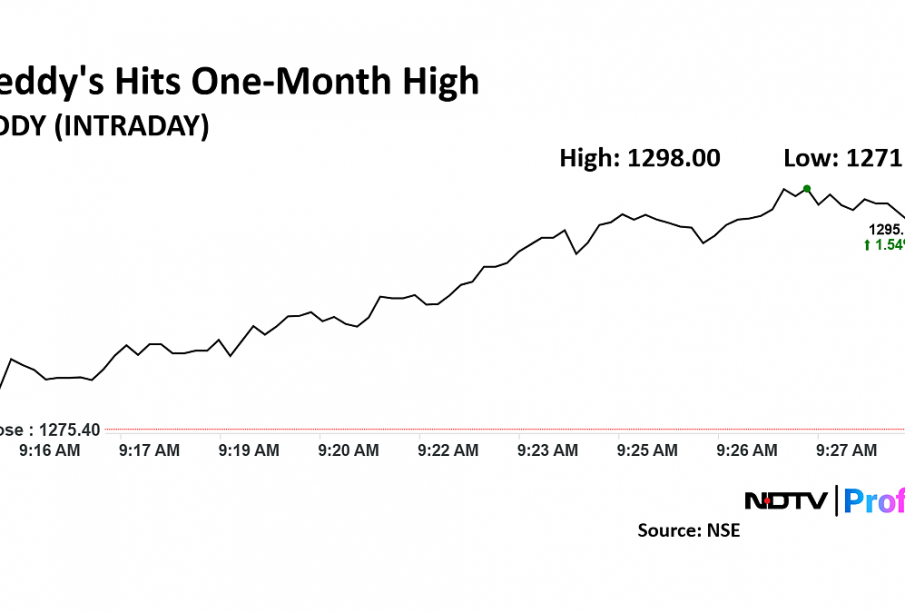

Current Share Price Trends

As of mid-October 2023, Dr Reddy’s share price has seen notable fluctuations, recently trading around ₹5,200 per share. This represents a significant increase from its lows earlier this year, where the stock had dipped to approximately ₹4,800. Analysts attribute this rise to a combination of successful drug launches, robust earnings reports, and a growing global demand for generic medications.

Factors Influencing Share Price

Several key factors have contributed to the current price dynamics:

- Drug Approvals: Dr Reddy’s has recently received approvals for several critical drugs from regulatory bodies in the US and Europe, enhancing its revenue potential.

- Financial Performance: The company reported a 15% increase in revenue for the last quarter, boosted by strong sales in its key markets, including North America.

- Market Sentiment: Positive investor sentiment, driven by optimistic earnings forecasts and strategic expansions into emerging markets, has also played a role.

- Global Market Conditions: The ongoing recovery of global markets post-pandemic has increased consumer optimism, positively affecting stock prices across sectors.

Future Outlook

Looking ahead, industry experts are optimistic about Dr Reddy’s share price trajectory. The continued focus on research and development, alongside strategic collaborations for new drug formulations, positions the company well within the competitive landscape. Additionally, the potential for new markets, particularly in biosimilars and COVID-19 related products, adds to the bullish outlook.

Conclusion

In summary, Dr Reddy’s share price remains a pivotal point of interest for investors as the company navigates challenges and opportunities within the pharmaceutical sector. With ongoing developments and a strategic focus on growth, monitoring Dr Reddy’s share price in the coming months will be essential for making informed investment decisions. As always, potential investors are advised to perform due diligence and consider market risks before trading in shares.