Latest Insights on Union Bank Share Price

Introduction

The share price of Union Bank of India is often seen as an important indicator for investors in the banking sector. As a major public sector bank, changes in its stock price can reflect broader market trends and investor sentiment regarding the overall economic environment and banking sector health.

Current Share Price Trends

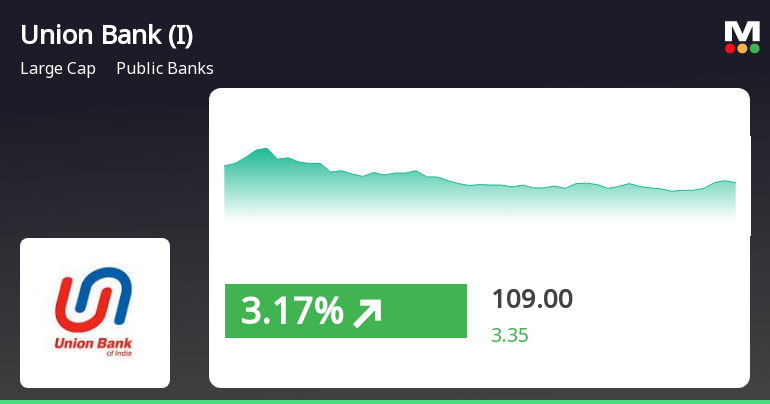

As of the latest reports in October 2023, the share price of Union Bank has shown significant volatility. After a remarkable rally in the first quarter, where the stock gained nearly 30%, the price settled around INR 104 per share. Analysts attribute this fluctuation to various factors, including changes in interest rates, quarterly earnings reports, and macroeconomic indicators like inflation and GDP growth.

In a recent update, Union Bank announced its quarterly results, which revealed a net profit increase of 24% year-on-year, significantly boosting investor confidence. This positive result contributed to a brief surge in share price, reaching a peak of INR 110 before correcting slightly. Experts suggest that sustained growth in asset quality and a decrease in non-performing assets (NPAs) have played a crucial role in these advancements.

Factors Influencing Share Price

Several external and internal factors can greatly impact Union Bank share price. Policy changes by the Reserve Bank of India, such as interest rate modifications or liquidity measures, directly influence banking stock valuations.

Moreover, global financial trends, including the performance of foreign markets and the Indian economy’s recuperation post-pandemic, have also contributed to the dynamics of Union Bank’s stock. For instance, increased foreign direct investment (FDI) into India has generally boosted investor sentiment, further reflecting in the bank’s stock performance.

Future Outlook

Looking ahead, analysts predict cautious optimism for Union Bank’s share price. With continued improvement in the Indian economy and banking sector reform, the share price may stabilize and possibly experience upward momentum. Investment strategies may center on the bank’s performance in the coming quarters, as market participants assess the efficacy of recent reforms and economic policies.

Conclusion

The Union Bank share price remains a key focus for investors monitoring trends in the banking sector. With promising quarterly performance and positive economic signals, the outlook appears optimistic. Investors should keep an eye on both domestic and global economic factors that may influence future valuations, making informed decisions in this volatile market.