Current Trends in DLF Share Price and Market Performance

Importance of DLF Share Price

The DLF share price is a crucial indicator for investors looking to understand the performance of one of India’s leading real estate development firms. As a publicly traded company, fluctuations in its stock price can reflect broader market trends, investor sentiment, and economic conditions affecting the real estate sector.

Current Market Performance

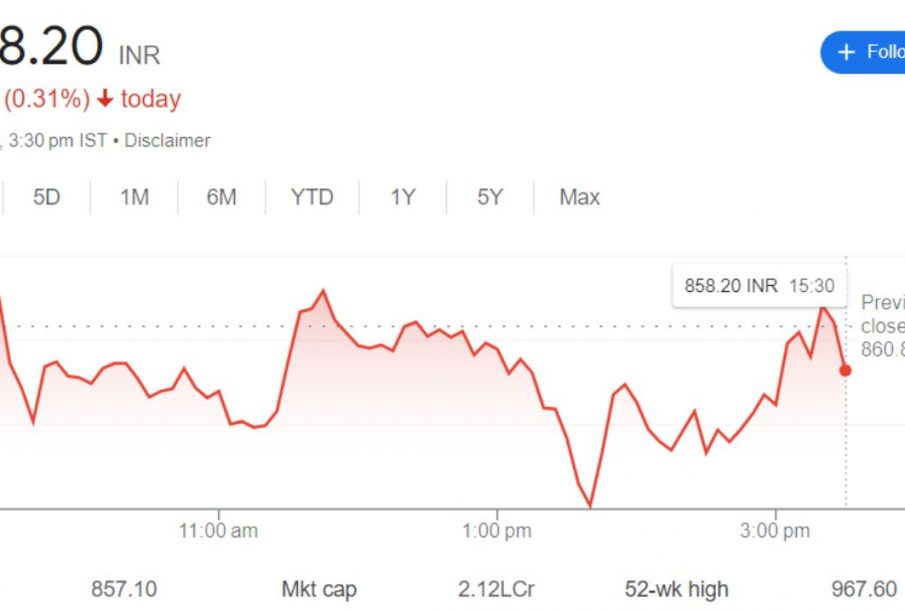

As of late October 2023, DLF Ltd. is witnessing a significant fluctuation in its share price, which is currently trading around ₹450 per share. Over the past month, the stock has seen a volatility range of approximately ₹425 to ₹470, influenced by various economic factors such as interest rate changes, inflation data, and real estate demand.

Experts attribute this volatility to recent developments in India’s real estate market. The government’s push toward affordable housing and infrastructure development has positively impacted the sector, with DLF aiming to capitalize on these opportunities by launching numerous residential projects. Moreover, the real estate company has reported an increase in net sales during the last quarter, reflecting positive consumer sentiment.

Recent Debates and Projections

Market analysts express mixed opinions on the DLF share price forecasting. Some believe that the stock is set to rise further due to expected increases in demand for housing, especially in urban areas. On the other hand, others caution against potential declines, citing the ongoing global economic uncertainties and potential policy changes.

Furthermore, the performance of the DLF share price is closely monitored by foreign investors. Their confidence in the Indian real estate market’s resilience can significantly impact share performance. Notably, the recent introduction of regulatory reforms has increased foreign direct investment (FDI) in real estate, providing a bullish outlook for stocks like DLF.

Conclusion and Significance for Investors

In conclusion, understanding the DLF share price and its movements is crucial for investors and stakeholders in the real estate sector. The company’s strategic initiatives, along with prevailing market conditions, will continue to play a vital role in determining its stock performance.

Investors should keep a close eye on upcoming quarterly results, government policies, and macroeconomic indicators, as they will be critical in shaping the future outlook for DLF’s share price. With the real estate sector poised for growth, DLF could be a valuable addition to investment portfolios for those looking to capitalize on this upward trajectory.