Understanding the Nifty Option Chain: A Comprehensive Guide

Introduction

The Nifty Option Chain is a vital tool for investors and traders in the Indian financial markets. It provides insights into the market’s expectations for future movements and allows traders to make informed decisions regarding their strategies. Understanding the Nifty Option Chain is essential, especially during times of market volatility and economic uncertainty, making it relevant for both new and experienced traders.

What is the Nifty Option Chain?

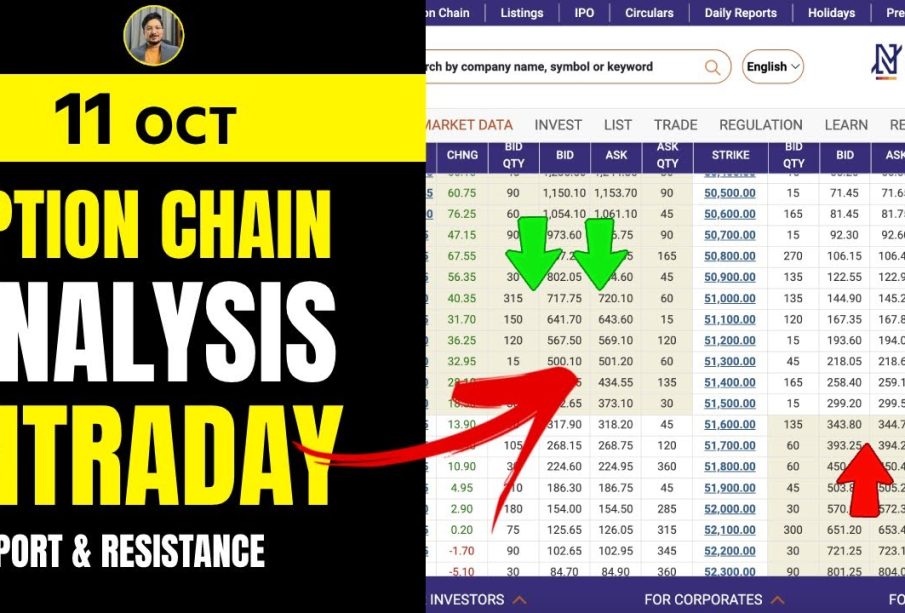

The Nifty Option Chain is essentially a collection of data pertaining to options trading on the Nifty 50 index, which comprises the 50 largest publicly traded companies listed on the National Stock Exchange of India (NSE). Options are financial derivatives that give buyers the right, but not the obligation, to buy or sell the underlying asset at a specified price within a specified time frame. The option chain lists both call and put options for various strike prices and expirations, thus providing a comprehensive view of market sentiment.

Latest Developments

As of October 2023, the Nifty Option Chain has shown an increase in open interest, particularly in the 18,000 and 19,000 strike prices. This trend indicates that traders are expecting significant price movements around these levels, possibly due to upcoming earnings reports and macroeconomic factors influencing the market. Data from the NSE shows that the overall trading volume for Nifty options has surged, highlighting increased participation from retail investors as well as institutional players.

Strategies Using the Nifty Option Chain

Traders leverage the Nifty Option Chain in various ways, including:

- Directional Trading: By analyzing open interest and the volume of options at different strike prices, traders can forecast potential price movements.

- Hedging: Investors use options to hedge their portfolios against market volatility, buying puts to protect long positions or calls to cover shorts.

- Spreads and Combinations: Traders often employ complex strategies like straddles and strangles to capitalize on expected movements with limited risk.

Conclusion

The Nifty Option Chain remains a significant resource for traders looking to navigate the complexities of the Indian stock market. As it reflects market sentiment and trading volumes, becoming adept at reading the option chain can enhance a trader’s ability to make profitable decisions. With the volatility trends and strategies evolving continually, traders who keep a pulse on the Nifty Option Chain will be better positioned to adapt and succeed in the dynamic financial environment. Understanding its nuances can thus provide a crucial edge in trading strategies and investment decisions.