Understanding the Latest Trends in Meta Share Price

Introduction

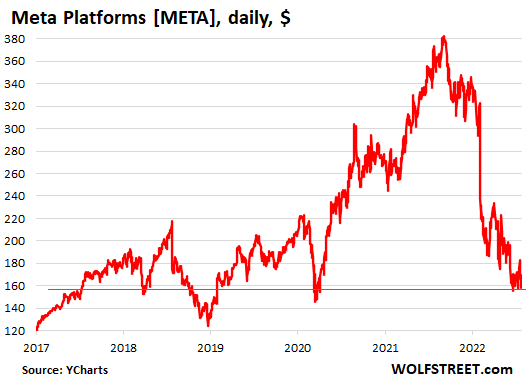

The share price of Meta Platforms Inc., known for its flagship products like Facebook, Instagram, and WhatsApp, has been a significant focal point for investors and analysts alike. With technology stocks facing fluctuations due to economic factors and market sentiment, tracking Meta’s share price is essential for making informed investment decisions. Recent updates in the tech sector and the company’s performance during the last quarter have added more context to its stock trajectory.

Current Performance and Influencing Factors

As of October 2023, Meta’s share price has seen a notable recovery following a series of market downturns earlier this year. The stock is currently trading around $350 per share, marking an increase of 15% over the past month. This resurgence can be attributed to several factors:

- Enhanced Revenue Streams: Meta has successfully diversified its revenue through advertising improvements and the integration of e-commerce features across its platforms.

- Strong Quarterly Results: In the last earnings report, Meta exceeded analyst expectations, showcasing revenue of $34.5 billion, largely driven by digital advertising.

- Metaverse Investment: While still a long-term play, Meta’s commitment to the metaverse has kept investor interest alive, with several projects underway aimed at enhancing virtual experiences.

Market Trends Impacting Meta

Global economic conditions and regulatory scrutiny over tech companies also play a crucial role in Meta’s stock performance. Factors such as rising interest rates, inflationary pressures, and potential antitrust regulations can create volatility. The tech sector, in general, is sensitive to investor sentiment regarding broader economic forecasts, making monitoring macroeconomic data important for future predictions.

Conclusion

Tracking the Meta share price is vital for those interested in technology stocks. As the company navigates challenges, including economic headwinds and regulatory environments, investors remain hopeful about its future potential. Current trends suggest that while volatility may persist, Meta’s strong fundamentals and adaptability could bode well for its share performance in the long run. For investors, remaining observant of both company-specific announcements and broader market conditions will be key to capitalizing on opportunities in the fluctuating stock market.