Understanding the KOSPI Index and Its Economic Impact

Introduction

The KOSPI Index, or Korea Composite Stock Price Index, serves as a vital indicator of the South Korean stock market’s performance. As one of the key benchmarks in Asia, the KOSPI provides insights into the economic health of South Korea, making it an important focus for investors, analysts, and policymakers alike. With its fluctuating values influenced by regional and global economic trends, understanding the KOSPI Index is essential for anyone interested in the financial markets.

Main Body

Established in 1983, the KOSPI Index comprises over 800 companies listed on the Korea Exchange. This includes many of South Korea’s largest and most prominent firms such as Samsung Electronics, Hyundai Motor, and SK Hynix. The index is weighted by market capitalization, meaning larger companies have a more significant impact on the index’s movements than smaller ones.

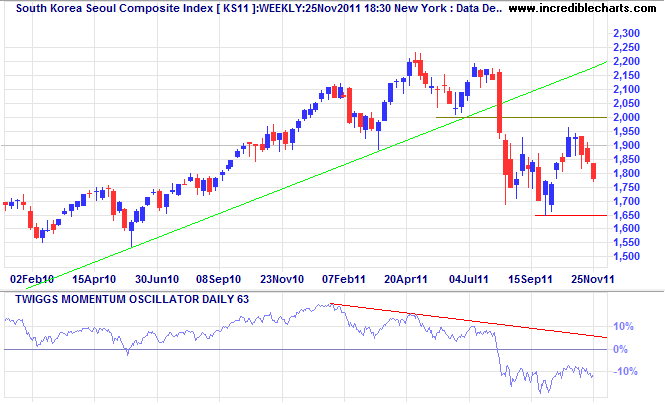

Recently, the KOSPI has shown some volatility, reflecting broader global market concerns, including the impact of inflation and ongoing geopolitical tensions. As of October 2023, the KOSPI Index has fluctuated between 2,300 to 2,600 points, indicating heightened investor caution driven by external economic factors. Analysts predict that sustained shifts in interest rates and global economic conditions could lead to more aggressive trading behaviors within the index.

Moreover, the South Korean economy has faced substantial challenges due to rising energy prices and supply chain disruptions. The government’s measures to accommodate these changes play a pivotal role in stabilizing the index. Furthermore, initiatives aimed at boosting innovation in technology and green energy sectors have had implications for stocks listed on the KOSPI.

Recent Developments

In recent weeks, there has been a noticeable uptick in foreign investments into the KOSPI, attributed to its appealing valuation relative to other global markets. Initiatives by the South Korean government to streamline regulations for foreign investors have also contributed positively. As of late September 2023, foreign net buying had surged, providing much-needed support for the index.

Conclusion

The KOSPI Index remains a fundamental component of South Korea’s financial landscape, reflecting both domestic and global economic realities. Market observers predict that continued foreign interest and governmental policies focused on economic stability could help the index navigate the current challenges. For investors, monitoring the KOSPI offers not just a glimpse of the South Korean market but insights into overall trends in Asia, making it a barometer for financial health across the region. Moving forward, adaptability will be essential as market dynamics evolve amid ongoing global uncertainties.