Understanding the BSE Small Cap Index in 2023

Introduction to the BSE Small Cap Index

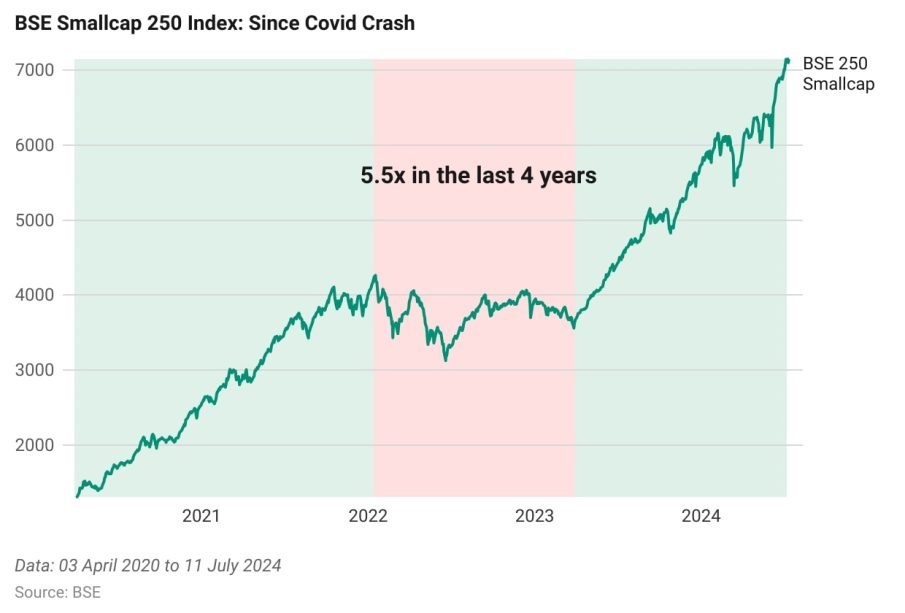

The BSE Small Cap Index is a crucial barometer for investors looking to tap into the potential of smaller companies listed on the Bombay Stock Exchange (BSE). It represents the performance of small-cap stocks, which are defined as companies with relatively low market capitalizations compared to their larger counterparts. Understanding this index is vital, especially in the current market landscape, as it not only reflects the health of the small-cap segment but also provides insights into broader economic trends.

Current Trends in the BSE Small Cap Index

As of the end of October 2023, the BSE Small Cap Index has shown remarkable resilience and growth, outperforming several other indices. The index has gained over 25% in the past year, driven by positive investor sentiment and robust performance from sectors like technology, healthcare, and consumer goods. Analysts attribute this growth to several factors, including the post-pandemic economic recovery, government initiatives aimed at supporting small businesses, and an increase in retail participation in stock markets.

Moreover, small-cap stocks have become appealing for investors looking for higher returns, especially as large-cap stocks experience volatility. The recent earnings season has seen many small-cap companies reporting strong quarterly results, further enhancing investor confidence.

Investment Opportunities and Risks

Investing in the BSE Small Cap Index carries the potential for significant rewards but also comes with inherent risks. Small-cap stocks are often more volatile than larger companies, making them susceptible to sharp price movements based on market sentiment. Investors should conduct thorough research and consider their risk tolerance before diving into this segment.

Moreover, while some sectors are currently thriving, others may face challenges due to inflationary pressures and supply chain disruptions. Diversification remains a key strategy for investors looking to navigate these waters, as it can help mitigate risks associated with individual stocks.

Conclusion: The Future of the BSE Small Cap Index

Looking ahead, the BSE Small Cap Index is expected to remain a crucial area of interest for investors. Economic indicators suggest that as India continues to grow and modernize, many small enterprises will benefit from increased demand and investment opportunities. However, prudent investment choices are necessary to maximize benefits while managing risks. By keeping an eye on market developments and sector performances, investors can capitalize on the growth potential of the BSE Small Cap Index in the coming years.