Understanding Refex Share Price Fluctuations

Introduction

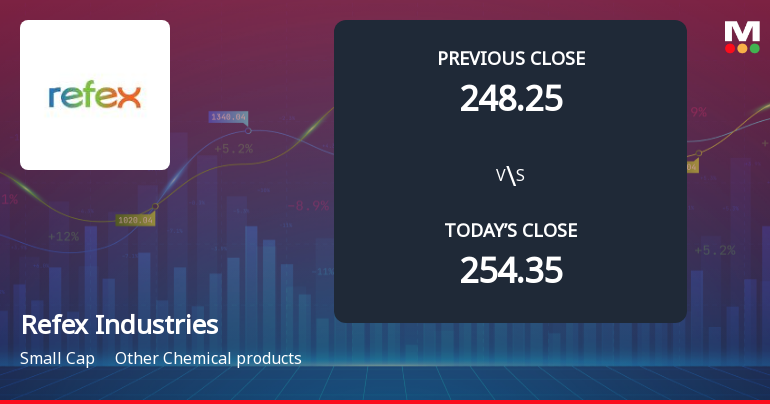

The share price of Refex Industries, a prominent player in the Indian chemical segment, has been a topic of keen interest for investors and market analysts alike. In the wake of fluctuating market conditions and changing industry dynamics, understanding the trends in Refex’s share price is vital for both current stakeholders and potential investors. This article explores the recent developments influencing Refex’s stock and the projections for the near future.

Current Market Overview

As of early November 2023, Refex Industries has been experiencing a notable rise in its share price, currently trading at around ₹120, reflecting a growth of approximately 15% over the past month. This uptrend can be attributed to several factors including increased demand for specialty chemicals, strategic partnerships, and improvements in operational efficiency.

Analysts suggest that the recent technological advancements implemented by Refex have enhanced its production capabilities, thereby boosting investor confidence. Additionally, the company’s diversification into renewable energy sources has opened new avenues for revenue, further underpinning its stock value.

Influencing Factors

1. Industry Growth: The specialty chemicals sector is projected to grow significantly, with an increasing demand for eco-friendly substances driving the market. Refex’s alignment with these industry trends reinforces its position within the sector.

2. Strategic Collaborations: Refex has recently partnered with international firms to expand its market reach, which is expected to yield positive results on its financial performance and by extension, its share price.

3. Financial Health: Solid quarterly earnings reported by Refex have further fueled investor interest, indicating a commitment to growth and profitability.

Conclusion

The Refex share price remains a focal point for investors amid a recovering market. Analysts predict moderate growth in the upcoming quarters, particularly as the company capitalizes on emerging opportunities within the specialty chemicals market and renewable energy sector. Looking ahead, stakeholders should remain vigilant to market trends and corporate announcements that could influence the share price. Overall, Refex appears poised to enhance its market standing, offering attractive prospects for current and future investors.