Understanding PFC Share Price: Current Trends and Implications

Introduction

PFC (Power Finance Corporation Limited) plays a crucial role in the Indian financial landscape, particularly in financing power sector projects. The share price of PFC is not only significant for investors but also reflects broader economic activities within the energy sector. As India navigates through various energy transitions and investments in infrastructure, monitoring the PFC share price gives valuable insights into investor sentiment and market dynamics.

Current Share Price Overview

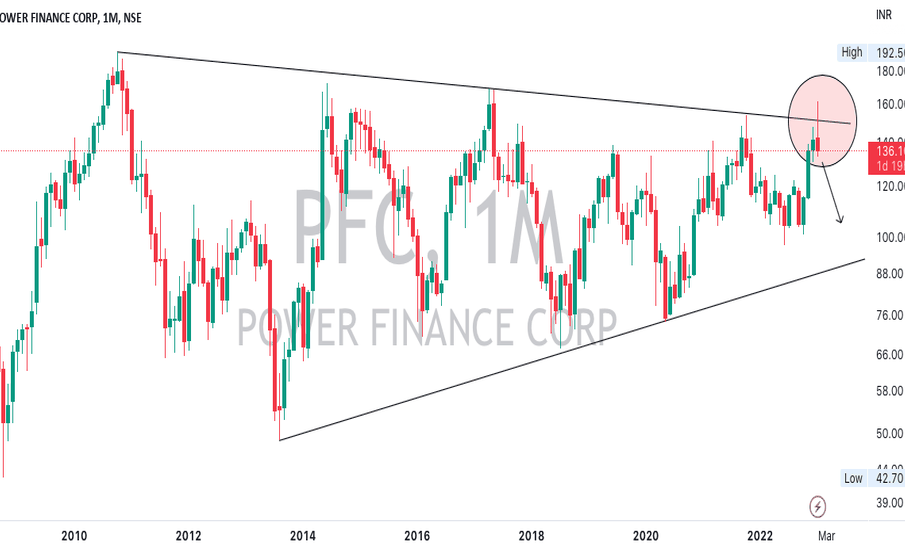

As of October 2023, PFC’s share price showed notable fluctuations, trading around ₹195 per share. This price highlights a recovery trend from earlier dips, largely attributed to a series of positive earnings reports and government initiatives to boost the power sector. The company reported a Q2 FY2024 profit growth of 15% year-on-year, outperforming market expectations. Analysts suggest that this growth is a result of improved asset quality and higher loan disbursements.

Factors Influencing PFC Share Price

Several factors contribute to changes in PFC’s share price, including:

- Government Policies: The Indian government’s push for renewable energy adoption and its various schemes for the power sector heavily influence investor confidence.

- Financial Performance: Quarterly results reflect the company’s health, where rising profits and decreasing NPAs (Non-Performing Assets) can contribute positively to the share price.

- Market Sentiment: Global economic factors, including interest rate changes and market volatility, can lead to quick shifts in share price.

Investor Insights and Outlook

Market analysts suggest mixed forecasts for PFC’s stock. While some view the current share price as undervalued, anticipating growth driven by strategic governmental reforms and infrastructure investments, others caution about external economic pressures that could adversely affect financial performance in the next few quarters. Investors are encouraged to keep a close watch on the upcoming policy announcements and sectoral developments for informed decision-making.

Conclusion

In conclusion, PFC’s share price remains a critical indicator of the overall health of the power sector in India. With ongoing investments and a supportive policy environment, there is a potential for increased investor interest. However, attention to market conditions and economic indicators is essential for making knowledgeable investment choices. As developments unfold in the power sector, monitoring PFC share price will be key for investors looking to capitalize on opportunities in this vital segment of the economy.