Understanding Crude Oil Price Trends and Their Impact

Introduction

Crude oil prices are a crucial indicator of global economic health, as they affect not only energy costs but also the overall inflation rate and economic stability of countries reliant on oil imports. Recent fluctuations in crude oil prices due to geopolitical tensions and supply chain issues highlight the importance of this topic for consumers, governments, and investors alike.

Current Trends in Crude Oil Pricing

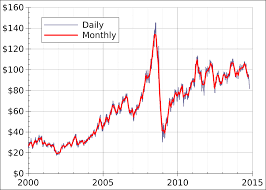

As of October 2023, crude oil prices have seen significant volatility, reaching levels not observed in previous years. According to the latest reports from the U.S. Energy Information Administration (EIA), West Texas Intermediate (WTI) prices averaged around $90 per barrel this month, which marks a 20% increase since July. Concerns over production cuts by major oil-producing nations, such as OPEC+, and ongoing geopolitical tensions in regions like the Middle East have contributed to these rising costs.

Factors Influencing Price Changes

The primary factors driving the increase in crude oil prices include:

- Supply Constraints: OPEC+ countries have reduced output to stabilize prices, impacting global supply.

- Geopolitical Tensions: Escalating conflicts can lead to fears of supply disruptions, significantly affecting market sentiment.

- Demand Recovery: With many countries rebounding from pandemic restrictions, global demand for oil has surged, further straining the supply chain.

Future Outlook and Implications

Experts predict that unless there is a substantial increase in alternative energy sources or a resolution to current geopolitical issues, crude oil prices may continue to rise in the near future. This could lead to increased costs for transportation and goods, directly impacting inflation rates. Economists suggest that consumers and businesses should prepare for potentially higher energy prices in the coming months.

Conclusion

Understanding the dynamics of crude oil pricing is essential not just for investors but for every individual who relies on energy in their daily lives. The current trends highlight the interconnectedness of global markets and the significant impact that crude oil has on economic stability. As we move forward, monitoring these trends will be crucial for making informed financial and policy decisions.