Silver ETFs: A Booming Investment Option for Diversification

Introduction

In recent years, silver exchange-traded funds (ETFs) have gained significant popularity among investors looking for diversification in their portfolios and a hedge against inflation. As a precious metal, silver holds intrinsic value, and with economic uncertainties looming, many are turning to silver ETFs as a safer investment alternative. This article delves into the current trends, advantages, and considerations surrounding silver ETFs, highlighting their relevance in today’s economic landscape.

Current Trends in Silver ETFs

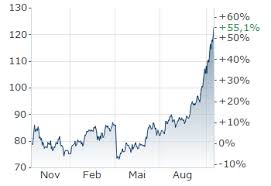

According to recent data from the World Silver Survey, demand for physical silver has surged, particularly in sectors such as industrial applications and technology. This rising demand contributes to the increasing value of silver ETFs. In 2023, the assets under management in silver ETFs reached a record high of over $20 billion, showcasing a growing interest from both retail and institutional investors.

Investment inflows into silver ETFs have been accentuated by a general flight to safety due to global economic challenges, inflationary pressures, and geopolitical tensions. As central banks continue to implement accommodative monetary policies, precious metals like silver are viewed as reliable assets that can preserve wealth and provide potential profit margins.

Advantages of Investing in Silver ETFs

Investing in silver ETFs holds several advantages: Firstly, these funds offer a simple way to gain exposure to silver without requiring investors to buy, store, or insure physical silver. Secondly, silver ETFs often have lower expense ratios compared to mutual funds or other investment vehicles, making them a cost-effective option for investors. Additionally, they provide liquidity, allowing investors to buy and sell shares easily in the stock market.

Considerations and Risks

While silver ETFs offer numerous benefits, potential investors should also consider the associated risks. The price of silver can be highly volatile, influenced by various factors such as supply and demand dynamics, currency fluctuations, and economic conditions. Therefore, it is essential for investors to conduct thorough research and possibly seek professional financial advice before making investment decisions related to silver ETFs.

Conclusion

With the growing trend of investing in silver ETFs, it’s clear that investors recognize the potential of precious metals in achieving diversification and protecting wealth. As the market evolves, staying informed about trends and understanding the dynamics of silver will be crucial for anyone considering this investment avenue. Silver ETFs are establishing themselves as a significant player in the investment landscape, offering opportunities for both growth and security in uncertain times.