Shakti Pump Share Price: Current Trends and Insights

Introduction

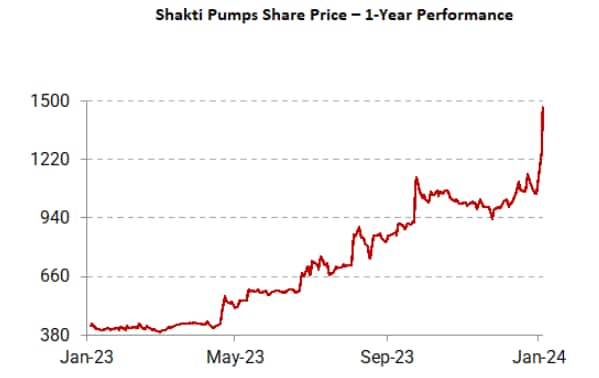

The share price of Shakti Pumps (India) Ltd. has garnered significant attention among investors and financial analysts lately. As a notable player in the manufacturing of submersible pumps and solar products, understanding the fluctuations in its stock price is crucial for potential investors. Monitoring these price changes not only provides insights into the company’s performance but also reflects broader trends in the industrial and renewable energy sectors.

Current Market Performance

As of October 2023, Shakti Pumps’ share price has experienced notable volatility, primarily influenced by market dynamics, international trade measures, and domestic policies promoting renewable energy. Recent reports indicate that the share price is trading around ₹400 per share, reflecting a price increase of approximately 15% over the last month. This uptick follows a robust financial performance in the previous quarter, where the company reported a 20% increase in revenue compared to the same period the previous year.

Factors Affecting Share Price

The rise in Shakti Pump’s share price can be attributed to several key factors:

- Government Initiatives: The Indian government’s push for solar energy and sustainable technology has spurred demand for Shakti’s products.

- Global Supply Chain Recovery: As global supply chains stabilize post-pandemic, the manufacturing sector’s revival has positively impacted the company’s production capabilities.

- Technological Advancements: Continuous investments in R&D have enabled Shakti Pumps to offer innovative products, enhancing its market position.

Investor Insights

Market analysts have mixed opinions regarding the future trajectory of Shakti Pump’s shares. Some analysts suggest that the current upward momentum could continue, driven by increasing renewable energy adoption and international expansion plans. However, others caution that fluctuations in raw material prices and global economic uncertainties could present risks in the near future. Investors are advised to keep a close watch on quarterly earnings reports and industry trends to make informed decisions.

Conclusion

In conclusion, Shakti Pumps’ share price remains a focal point for investors as it reflects the company’s operational strength and adaptability to market conditions. The emphasis on green energy solutions positions it well for future growth. Potential investors should evaluate current performance metrics and market conditions to understand the implications on the share price. With ongoing innovation and favorable government policies, Shakti Pumps could present compelling opportunities for investment in the years to come.