nmdc share price: Latest market snapshot and fundamentals

Introduction: Why nmdc share price matters

The nmdc share price is a key indicator for investors tracking India’s largest iron ore producer. Movements in NMDC’s stock affect not only equity portfolios but also sentiment in the metals sector and related commodity-linked industries. Regular updates on price and fundamentals help retail and institutional investors assess value, income potential and relative risk.

Main body: Latest prices, performance and fundamentals

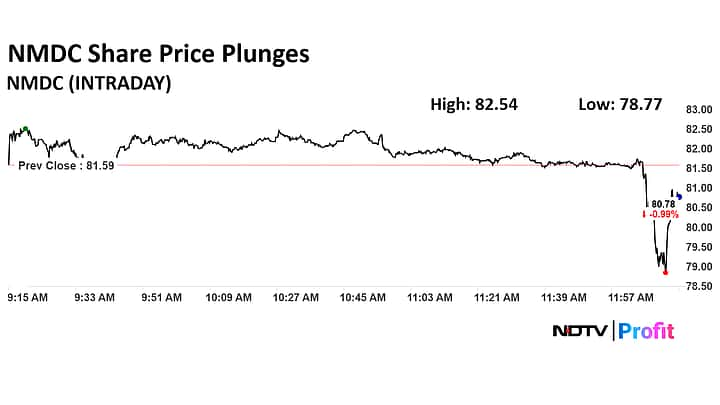

Market close and intraday range

As per the provided information, NMDC share price today stood at ₹81.44 at the market close on February 2, 2026 (4:01 pm IST). During the trading session the stock touched a day high of ₹81.9. Another quoted snapshot lists the stock at ₹81.44, showing a gain of ₹1.06 or 1.32% for that reference period.

Additional price references and ranges

One source lists a current price of ₹84.3 and reports a high/low of ₹86.8 / ₹59.5 (context as provided). These differing level indications reflect snapshots taken at different times or platforms; readers should note time stamps when comparing figures. The reported market capitalisation for NMDC is ₹74,133 Crore, indicating its large-cap status within the mining segment.

Key fundamentals provided

The supplied fundamentals show a price-to-earnings (P/E) ratio of 10.7, a book value of ₹36.9 and a dividend yield of 3.91%. These metrics provide a quick view of valuation (P/E), balance sheet backing per share (book value) and income potential via dividends (yield).

Conclusion: Takeaways and outlook for readers

For investors, the immediate takeaway is that NMDC shares were trading in the low-80s on the February 2, 2026 close, with session strength noted by a modest intraday high. Fundamental metrics—P/E 10.7, book value ₹36.9 and dividend yield near 3.9%—suggest a value-oriented profile among large-cap mining stocks based on the provided data. Readers should reconcile differing quoted prices by checking timestamps and exchange feeds, and consider these figures alongside broader market and commodity trends before making investment decisions.