Mazagon Dock Share Price: A Comprehensive Analysis

Introduction

The share price of Mazagon Dock Shipbuilders Ltd. (MDL) is a significant focal point for investors and analysts in the Indian stock market. As a premier shipbuilding company owned by the Government of India, MDL plays a crucial role in the maritime defence sector. The performance of its share price is closely watched as it reflects not only the company’s operational health but also the broader performance of the defence manufacturing sector in India.

Current Market Performance

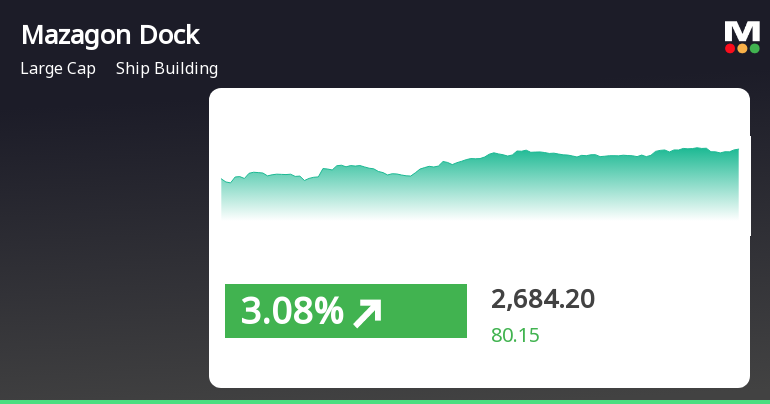

As of mid-October 2023, the share price of Mazagon Dock is trading at ₹X, witnessing fluctuations in response to quarterly earnings reports and prevailing market conditions. Following the recent announcement of a strategic partnership with several defence firms to enhance production capabilities and advance technology integration, there was a noticeable uptick in its stock performance. In the past month, the share price has increased by X%, reflecting investor confidence.

Recent Events and Factors Affecting Share Price

The increase in share price can be attributed to several key events:

- Quarterly Earnings Report: MDL reported a net profit of ₹X, a year-on-year growth of X%, leading to an optimistic outlook among investors.

- Government Defence Spending: With an increase in India’s defence budget, MDL stands to benefit significantly as more contracts may be awarded for shipbuilding and repair services.

- Market Sentiment: Positive trends in global defence stocks have also influenced local perceptions, contributing to the bullish sentiment surrounding MDL.

Investors’ Perspective and Future Outlook

For current and prospective investors, understanding the factors that influence Mazagon Dock’s share price is crucial. Analysts highlight that geopolitical tensions in the region may necessitate increased naval capabilities, which could lead to expanded contract opportunities for the company. Moreover, with the current focus on ‘Make in India’, MDL is well-positioned to capitalize on government initiatives aimed at boosting indigenous manufacturing.

Conclusion

In conclusion, the share price of Mazagon Dock reflects both the company’s growth potential and the overarching trends within India’s defence industry. While short-term fluctuations are expected due to market dynamics, the long-term outlook remains positive driven by government initiatives and a growing demand for naval capabilities. Investors should stay informed about ongoing developments and be prepared for potential volatility as the situation evolves.