Latest Trends in SBI Card Share Price

Introduction

The SBI Card share price has become a focal point for investors in the financial market amidst evolving economic conditions. As one of India’s leading card issuers, SBI Card has seen significant fluctuations in its share price, attracting attention from both retail and institutional investors. Understanding these changes is crucial for making informed investment decisions.

Current Share Price Overview

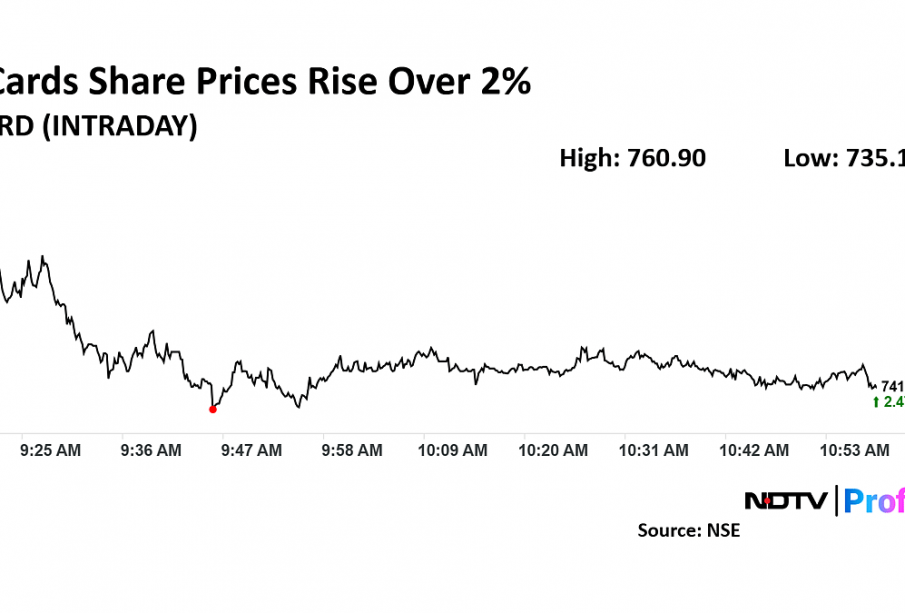

As of the latest trading session on October 20, 2023, SBI Card shares closed at ₹801.50, marking a slight decline of 1.23% from the previous trading day. The share price has been influenced by a variety of factors including the competitive landscape in the fintech sector, changes in regulation, and the overall economic climate. Over the past month, the stock has fluctuated between ₹780 and ₹850, indicating increased volatility.

Market Influencers

Several factors have contributed to the current trends in SBI Card’s share price. The recent announcement of reduced interest rates by the Reserve Bank of India (RBI) has improved the borrowing climate, positively impacting credit card usage and subsequently the revenue of SBI Card. Additionally, the increase in digital transactions during the festive season has projected favorable growth prospects.

Investor Sentiment

According to market analysts, sentiment remains cautiously optimistic regarding SBI Card. In a recent survey, approximately 65% of analysts recommended a ‘hold’ position on shares, while around 20% suggested a ‘buy’. The general concern includes rising inflation that could affect consumer spending and payment behavior. It is also essential to monitor the company’s quarterly results, which will provide insights into profitability and operational efficiency.

Conclusion

In summary, the share price of SBI Card continues to attract attention amidst various market forces at play. Investors should keep a close watch on market trends, regulatory changes, and quarterly performance, as these factors will shape the future trajectory of SBI Card shares. As we move closer to the end of the fiscal year, analysts suggest that the stock might continue to face volatility, with projections indicating a potential recovery as consumer sentiment remains resilient. Understanding these dynamics can better equip investors for upcoming opportunities in the capital market.