Latest Insights on Amazon Share Price

Introduction

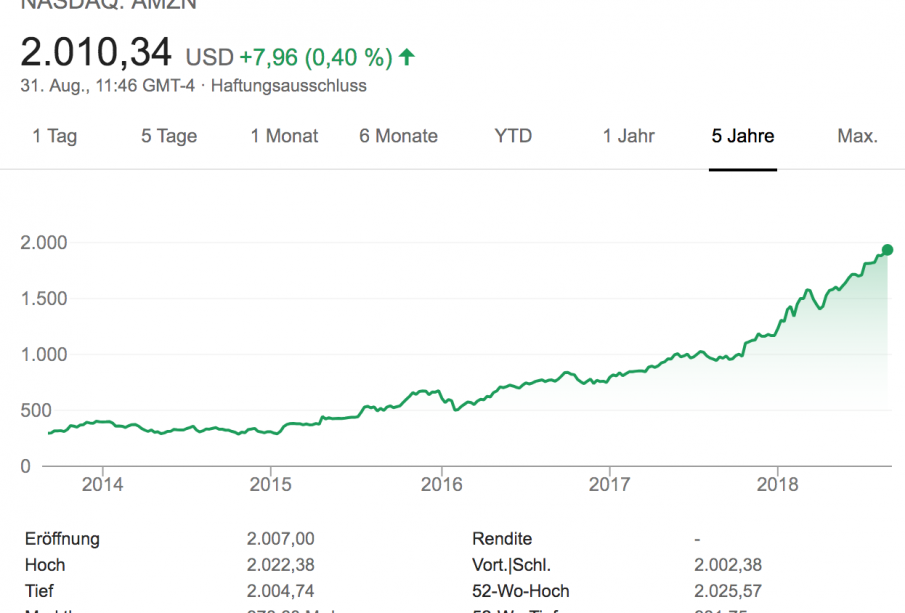

The share price of Amazon, one of the largest e-commerce and cloud computing companies in the world, holds significant importance in the stock market. As a major player in various sectors from retail to technology, the fluctuations in Amazon’s share price not only reflect company performance but also influence market trends and investor decisions. Understanding these trends can help shareholders and potential investors make informed decisions.

Current Trends and Analysis

As of October 2023, Amazon’s share price has shown remarkable resilience amidst a volatile economic environment. The company’s shares have exhibited a strong upward trajectory, reaching approximately $150 per share recently, marking a significant increase of about 25% in the past six months. Analysts attribute this growth to a mixture of strong quarterly earnings exceeding forecasted margins, expansion in cloud services through Amazon Web Services (AWS), and an increase in consumer demand during the holiday season.

Additionally, the recent announcement of new Prime membership benefits and investments in logistics have been positively received by the market, reinforcing investor confidence. Historical data indicates that during similar periods leading up to the holiday season, shares of Amazon typically perform well, largely due to increased consumer spending.

Implications for Investors

For investors, the present optimism surrounding Amazon’s share price is underscored by recommendations from financial analysts. Many suggest that shares are currently undervalued, projecting a target price of around $165 by mid-2024. However, investors are advised to remain cautious about potential volatility due to market shifts, economic indicators, and changes in consumer behavior post-pandemic.

The company’s ability to innovate and adapt to changing market conditions, such as the ongoing push for artificial intelligence and sustainable business practices, are also expected to drive future growth potential.

Conclusion

In conclusion, the Amazon share price is trending upwards driven by solid operational performance and positive market expectations. While there are signals suggesting that this upward trend may continue, it is paramount for investors to closely monitor market conditions and remain aware of external factors that could impact performance. As Amazon evolves and responds to both opportunities and challenges, its share price remains a critical focal point for both short and long-term investment strategies.