Current Trends in Titagarh Share Price

Introduction

The stock market plays a crucial role in the Indian economy, serving as a key indicator of financial health and investor sentiment. Among the various companies listed, Titagarh Wagons Ltd., a key player in the transportation and manufacturing sector, has drawn attention due to its fluctuating share price. Understanding the factors influencing the Titagarh share price is essential for investors and stakeholders looking to navigate this dynamic market.

Recent Performance and Trends

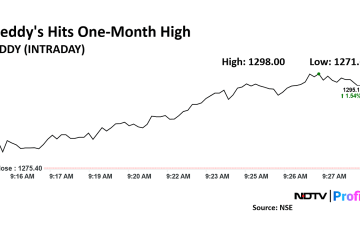

As of October 2023, the share price of Titagarh Wagons has demonstrated remarkable fluctuations influenced by multiple factors including market conditions, company performance, and macroeconomic indicators. The share price recently traded around ₹625, reflecting an increase of approximately 10% over the past month. This growth is attributed to the company’s recent contract wins in the rail industry and expansion plans in manufacturing.

Market Influences

Several factors have contributed to the recent performance of Titagarh shares:

- Order Book Growth: Titagarh has secured significant orders from Indian Railways, enhancing its business prospects and subsequently boosting investor confidence.

- Financial Results: In its latest quarterly results, the company reported a 15% increase in revenue year-on-year, casting a positive light on its operational capabilities.

- Industry Developments: The revival of the manufacturing sector post-pandemic and government initiatives towards infrastructure development have also played a crucial role in supporting the stock’s performance.

Future Outlook

The outlook for Titagarh’s share price is cautiously optimistic. Analysts predict that if the company maintains its growth trajectory and continues to secure government contracts, the stock could see further appreciation. However, potential investors should be aware of external factors that could lead to volatility, such as changes in government policy or global economic conditions.

Conclusion

In conclusion, the Titagarh share price reflects broader market dynamics and specific company developments. As the company continues on its path of growth and expansion, investors should remain alert to both opportunities and risks. Regular updates on financial performance and market conditions will be crucial for making informed investment decisions in the future.