Current Trends in NALCO Share Price: What Investors Should Know

Introduction

The share price of National Aluminium Company Limited (NALCO) is a crucial parameter for investors and market analysts, reflecting the company’s performance in the highly competitive metals industry. As a significant player in the aluminium sector, NALCO’s share price is influenced by various factors including global aluminium prices, demand-supply dynamics, and national policies. In recent months, there has been considerable interest in NALCO, making it imperative to understand the current trends in its share price.

Recent Share Price Trends

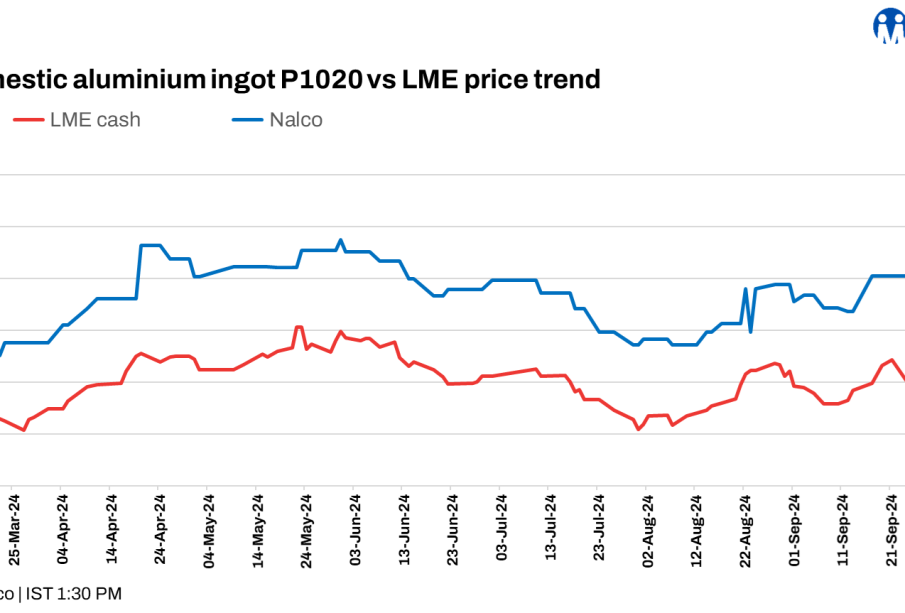

As of mid-October 2023, NALCO shares have seen a noteworthy fluctuation, with the stock price recently trading around INR 86 per share. This represents a slight increase from the previous month, where shares were trading at approximately INR 82. The rise in share price aligns with the general recovery in the metal markets, buoyed by increased global demand for aluminium in sectors such as construction and automotive manufacturing.

In addition to global market dynamics, local factors such as the government’s push for infrastructure development and initiatives promoting domestic manufacturing have positively impacted NALCO’s prospects. Moreover, investors are optimistic about NALCO’s strategic moves to enhance production capacity which are expected to yield positive results in the coming quarters.

Market Sentiment

Market analysts have expressed mixed sentiments about the sustainability of NALCO’s share price increase. While some believe that ongoing improvements in demand could lead to further growth, others caution against potential volatility due to fluctuations in the international aluminium market and rising energy costs that could impact profit margins.

Outlook for Investors

For current and prospective investors, the outlook for NALCO remains cautiously optimistic. Analysts advise to monitor key financial indicators such as quarterly earnings reports and global aluminium pricing trends closely. Additionally, any developments in domestic policies regarding mining and metal production will also play a significant role in shaping NALCO’s future performance. Investment strategies should, therefore, consider both market conditions and NALCO’s internal capabilities to adapt to changing demand landscapes.

Conclusion

The NALCO share price has shown resilience amid fluctuating market conditions, offering potential opportunities for investors while also presenting risks. It is essential for stakeholders to stay informed about regional and global developments that may impact NALCO’s performance. Continued investment in infrastructure and manufacturing in India may further bolster NALCO’s position in the market, making it an intriguing option for investors as they navigate the dynamic landscape of the metals sector.