Current Trends in BEL Share Price: Insights for Investors

Introduction

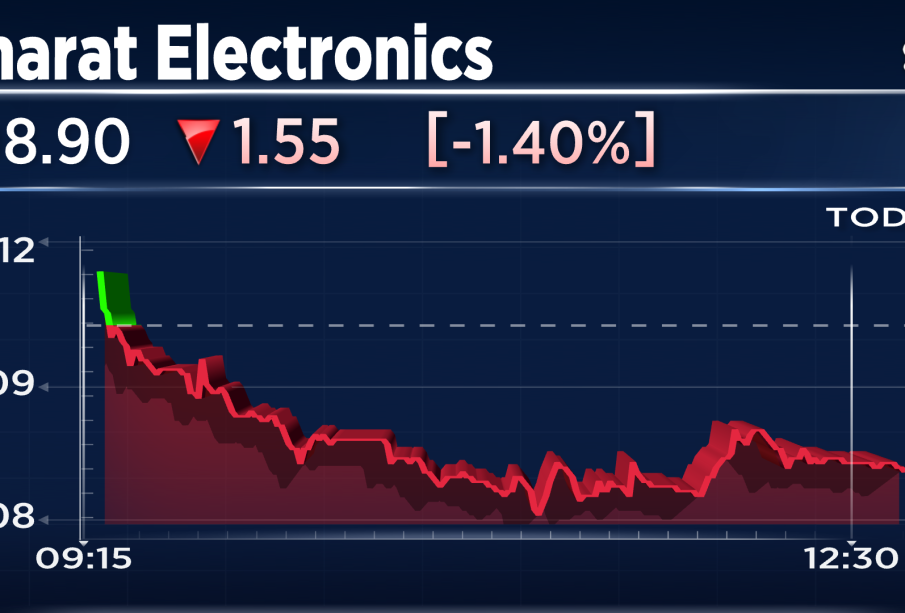

The Bharat Electronics Limited (BEL) share price has garnered significant attention from investors and analysts alike due to its robust performance in the defense sector. As a Navratna public sector enterprise under the Ministry of Defence, BEL plays a crucial role in India’s indigenization policy. Understanding the movements and trends of BEL share price is essential for those looking to invest in the Indian stock market, especially given the company’s strategic importance in the ever-evolving defense landscape.

Recent Developments Affecting BEL Share Price

As of October 2023, BEL’s share price has shown resilience amidst market fluctuations. Recently, the company reported a 15% increase in its quarterly profits, primarily driven by rising demand for electronic defense systems. This positive financial outcome is a testament to BEL’s strategic contracts with the Indian government, which continue to boost its revenue.

Additionally, the Indian government’s push for self-reliance in defense production has further bolstered investor confidence. Recent announcements regarding the allocation of funds for modernization of defense capabilities are expected to result in increased orders for BEL, consequently impacting its share price positively.

Market Analysis

Experts suggest that the outlook for BEL share price remains optimistic, fueled by long-term contracts and the increase in defense spending by the government. Current trading patterns indicate a resistance point around ₹1100, with predictions suggesting it could breach this mark within the next quarter. The stock has a healthy P/E ratio compared to its peers, indicating that it is fairly valued and offers potential upside for investors.

Conclusion

For investors looking at BEL as a potential portfolio addition, understanding its share price dynamics is crucial. The combination of strong government backing, increasing demand for defense electronics, and positive financial results points towards a brighter future. However, it is essential for investors to conduct their thorough research and consider market conditions before making any investment decisions. The defense sector is expected to continue its growth trajectory, and BEL’s performance will likely trend upwards, making it an attractive choice for long-term investment strategies.