Current Trends in Apar Industries Share Price

Introduction

Apar Industries, a key player in the power and telecommunication sector in India, has been witnessing significant fluctuations in its share price recently. Understanding these price movements is critical for investors as they reflect both company performance and market sentiment. As the country continues to progress towards infrastructure development and renewable energy, tracking the share price of such companies becomes increasingly important.

Recent Developments Affecting Share Price

As of October 2023, Apar Industries reported a notable increase in demand for its specialty oils and conductors owing to the surge in renewable energy projects across India. With investments pouring in from both private and public sectors, analysts suggest that the company’s revenues are poised for further growth. Furthermore, Apar Industries announced its recent partnership with international firms to expand its product range, providing a boost to investor confidence.

Market Performance

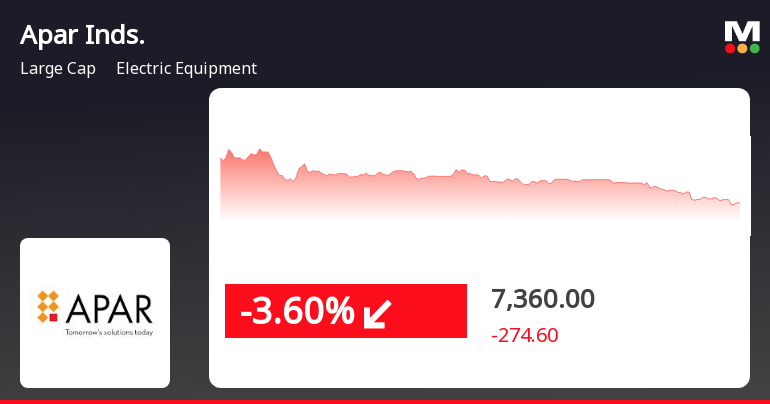

According to the Bombay Stock Exchange, Apar Industries’ share price has seen a growth of approximately 15% over the last three months. As of the latest figures, the shares are trading at around INR 643. The stock has been well received overall, reflecting a strong performance amid the broader market recovery post-pandemic. Analysts highlight that Apar Industries has robust fundamentals, including a stable balance sheet and strong return on equity, making it a preferred choice for long-term investors.

Future Outlook

Looking forward, experts predict that with increasing governmental push towards infrastructure and green energy, Apar Industries is set to maintain its upward trajectory in share price. Several analysts have issued ‘buy’ recommendations, anticipating that the stock could reach INR 700 by the end of 2023. However, investors are advised to remain cautious and consider potential market volatility and external financial factors that could influence share performance.

Conclusion

In conclusion, the developments surrounding Apar Industries and its share price are indicative of the company’s positive growth potential within the Indian market. As infrastructure and renewable energy take center stage, keeping a close watch on Apar Industries’ performance is crucial for current and potential investors. The fluctuations in share price not only represent the company’s health but also mirror larger economic trends that could affect various sectors in India.