Current DLF Share Price and Its Implications for Investors

Introduction

The share price of DLF Limited, one of India’s leading real estate development companies, plays a significant role in the Indian stock market, particularly in the real estate sector. Understanding DLF’s share price is critical for investors tracking market trends, as it reflects the company’s performance, future growth prospects, and the overall health of the real estate industry in India. As of mid-October 2023, DLF’s shares have shown notable fluctuations driven by various internal and external factors, making it a pivotal topic for potential and current investors.

Recent Trends

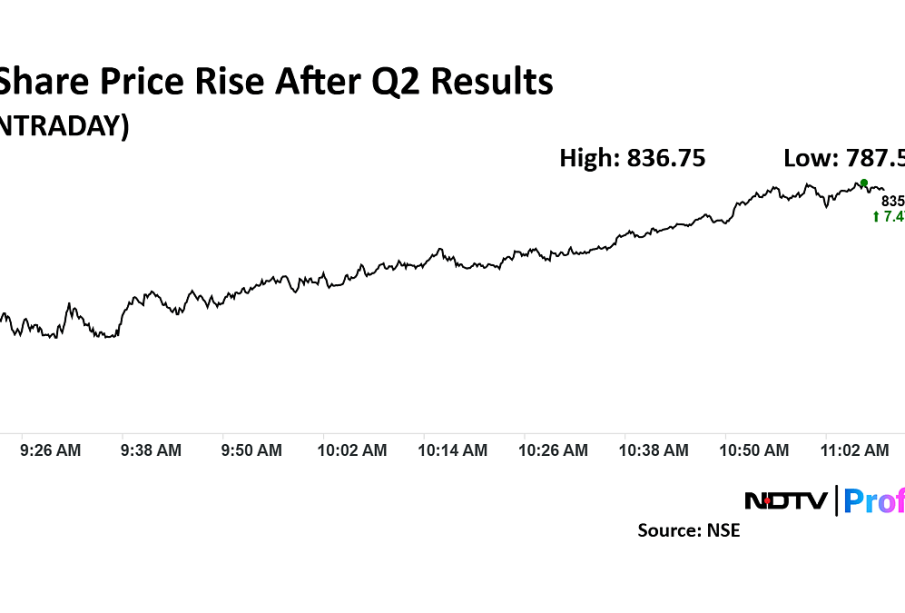

As of October 15, 2023, DLF shares are trading at approximately ₹450, reflecting a 2% increase compared to the previous week. Analysts attribute this uptick to several recent developments, including the company’s announcement of new project launches and robust quarterly earnings. The company reported a 15% increase in revenue for the second quarter of the fiscal year, which boosted investor confidence.

Market Analysis

Market experts suggest that the increasing share price is also linked to the government’s renewed focus on infrastructure development, which benefits real estate companies like DLF. Moreover, the positive sentiment surrounding the real estate sector, driven by both institutional and retail investors, is contributing to a bullish trend. However, some analysts caution that potential risks remain, such as fluctuations in interest rates and the overall economic environment, which could impact the real estate market and, consequently, DLF’s share price.

Conclusion

In conclusion, DLF’s current share price of ₹450 spotlights the ongoing optimism in the real estate sector amidst a recovering economy. For investors, tracking developments in DLF’s performance and the broader market is crucial. As the company ramps up its project pipeline and navigates potential economic challenges, observers will be keen to see how these factors impact the stock in the upcoming months. Analysts are suggesting that investors maintain a keen eye on DLF share price movements, particularly as the real estate market continues to evolve under changing economic conditions.