Nikkei 225: Understanding Japan’s Major Stock Index

Introduction: The Importance of Nikkei 225

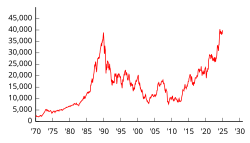

The Nikkei 225, often referred to simply as the Nikkei, is Japan’s premier stock market index, representing 225 of the largest publicly traded companies listed on the Tokyo Stock Exchange. Its significance extends beyond Japan, impacting global financial markets and investors. With the country being the third-largest economy in the world, understanding the dynamics of the Nikkei 225 is critical for anyone interested in international finance.

Current Performance and Recent Trends

As of early October 2023, the Nikkei 225 has shown promising signs of recovery, exhibiting a notable upswing after the turbulence caused by the COVID-19 pandemic. The index recently reached a new high, surpassing 33,000 points, driven by several factors including increased corporate earnings, a weaker yen, and robust foreign investment inflows. Major players such as Sony, Toyota, and SoftBank have posted strong quarterly results, contributing positively to market sentiment.

Analysts observe that the Nikkei’s performance is closely tied to global trends, especially movements in the U.S. market. The correlations between the Nikkei and major U.S. indices like the Dow Jones and S&P 500 become particularly pronounced as investor sentiment shifts in response to economic data from the West. The ongoing U.S. Federal Reserve’s policy decisions also play a crucial role; any indications of rate hikes can influence investor behavior globally.

The Influence of FDI and Domestic Policies

Foreign Direct Investment (FDI) has significantly affected the valuation of Japanese stocks. The government has actively encouraged investments through reforms and incentives aimed at bolstering growth. Moreover, Japan’s ongoing efforts to revitalize its economy post-pandemic, including initiatives to boost productivity and innovation, continue to gain traction, which in turn supports the Nikkei’s upward momentum.

Conclusion: Future Outlook of Nikkei 225

Looking ahead, the Nikkei 225 is expected to remain a focal point for investors. Economic indicators suggest a potential for continued growth, though various risks persist, including geopolitical tensions and fluctuations in global demand. As Japan advances toward a more sustainable economic model, the performance of the Nikkei 225 will likely reflect broader trends in the region. Investors and market watchers are advised to remain vigilant as they navigate the ever-evolving financial landscape dominated by this key index.