JBM Auto Share Price: Current Trends and Market Insights

Introduction

The share price of JBM Auto has become a focal point for investors and market analysts, especially in light of the recent developments within the automotive sector. JBM Auto, known for its diversified portfolio in manufacturing auto components and electric vehicles, is navigating through a rapidly evolving industry landscape. Keeping track of JBM Auto’s share price is crucial for potential investors looking to capitalize on market opportunities.

Recent Performance

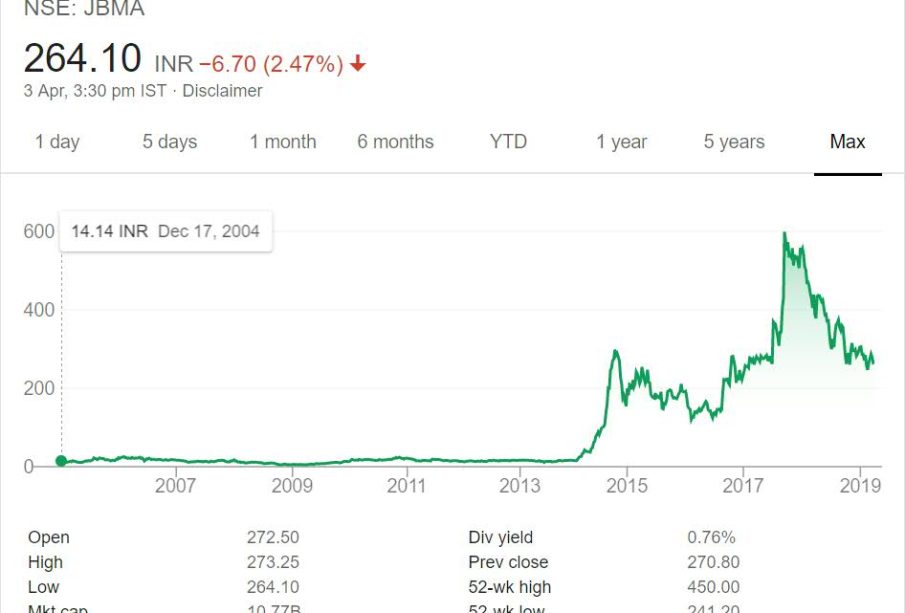

As of October 2023, JBM Auto’s share price has seen fluctuations tied to broader market trends and specific company milestones. Recently, the stock was trading around INR 320 per share, reflecting a slight increase compared to previous months. Analysts attribute this rise to JBM’s strategic partnerships and innovations in electric vehicle technology, which have sparked investor interest.

Market Factors Influencing Share Price

Several factors are currently influencing the share price of JBM Auto:

- Demand in Electric Vehicles: With a global shift towards sustainability, JBM Auto’s focus on electric vehicles has positioned the company favorably among competitors.

- Government Policies: Favorable government policies regarding electric vehicle production, subsidies, and infrastructure development have created a conducive environment for growth.

- Quarterly Earnings Reports: The company’s recent quarterly results indicated robust sales growth, which has bolstered investor confidence and positively impacted the stock price.

- Industry Trends: The overall automotive industry is experiencing transformations with advancements in technology and consumer preferences shifting towards greener options.

Future Outlook

Looking ahead, market analysts suggest that JBM Auto’s share price may continue to experience volatility due to external economic factors and competition in the automotive sector. However, the company’s initiatives towards expanding electric vehicle offerings and efficient manufacturing practices could lead to growth in share value over time. Investors are advised to keep an eye on quarterly performance reports and industry trends for more informed decision-making.

Conclusion

The JBM Auto share price is a reflection of both the company’s internal strategies and the external market dynamics. As the automotive industry evolves, JBM Auto’s efforts to align with sustainable practices may present significant opportunities for growth. Interested investors should stay updated on the company’s developments and market conditions to make strategic investment decisions. Ultimately, understanding the intricacies of JBM Auto’s share price trends may pave the way for lucrative investments in the future.