Understanding ABB Share Price Trends and Influencing Factors in 2023

Introduction

The share price of ABB Ltd., a global leader in electrification and automation technologies, has become a significant point of interest for investors in 2023. With the ongoing transitions in energy sectors and a push towards sustainable technologies, understanding ABB’s share price movements is crucial for stakeholders and market analysts alike.

Current Trends in ABB Share Price

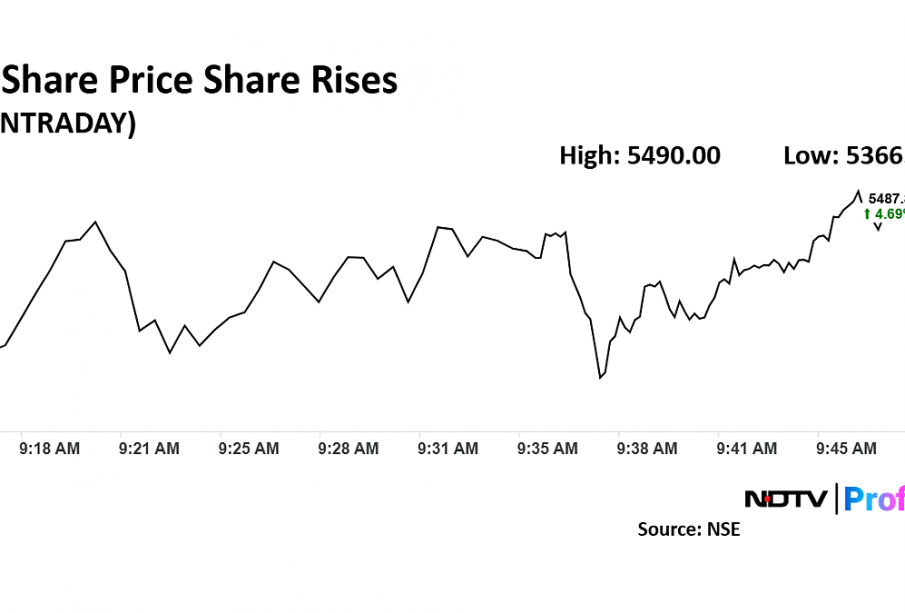

As of October 2023, ABB’s shares have shown volatility influenced by both macroeconomic factors and company-specific developments. Currently, the share price is approximately $30, a slight increase from the beginning of the year when it was around $25. This represents a noteworthy recovery in the aftermath of the global market downturn experienced in 2022 due to geopolitical tensions and inflation concerns.

Factors Influencing ABB’s Share Price

1. **Market Demands and Innovations**: ABB’s commitment to innovating in areas such as robotics, digitization, and electric vehicle charging infrastructure has bolstered investor confidence. Projects aimed at sustainability, especially in electrification and automation, have attracted both governmental and private investments, leading to positive outlooks on profitability.

2. **Global Economic Conditions**: The fluctuating economic climate, including changes in raw material prices and supply chain disruptions, have had ramifications for ABB’s operational costs and profit margins. Furthermore, rising interest rates globally add pressure on borrowing costs and can impact share evaluations.

3. **Financial Reports**: Recent quarterly earnings releases have shown promising revenue growth, primarily driven by increased demand for electrification products and services. The company reported a 12% increase in revenue year-on-year in their latest report, reflecting the effectiveness of their strategic initiatives.

Conclusion

For investors and analysts, the ABB share price serves as a barometer of the company’s performance and its resilience in a dynamic market. Going forward, continued focus on sustainable and digital solutions is likely to drive further growth. Investors should remain vigilant regarding global economic indicators and ABB’s strategic decisions, which will undoubtedly influence its future share price. Overall, ABB represents a compelling opportunity for those looking to invest in companies at the forefront of technological advancement and sustainability.