IDBI Share Price: Latest Trends and Market Insights

Introduction

The performance of bank shares is a critical indicator of the health of the financial sector, and IDBI Bank is no exception. As one of India’s prominent banking institutions, its share price movements hold significant relevance for investors, market analysts, and financial planners. As of late 2023, IDBI’s share price has been experiencing notable fluctuations, reflecting broader trends in the banking industry and investor sentiment.

Recent Performance of IDBI Share Price

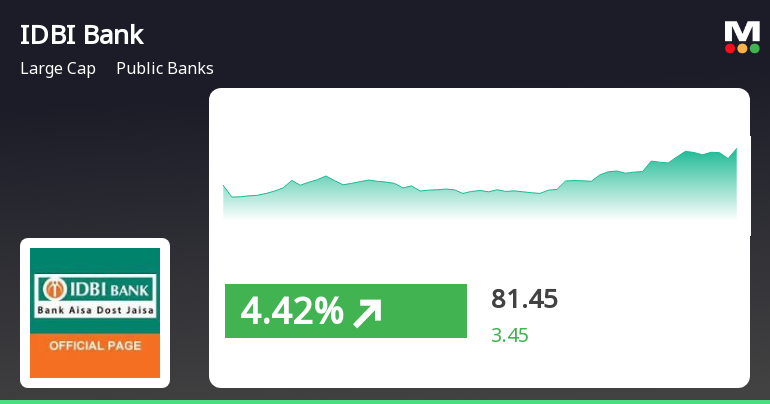

Over the past few months, IDBI Bank’s share price has shown remarkable resilience. As of October 2023, the share price hovered around INR 65, signifying an increase of approximately 8% over the last quarter. This rise can be attributed to several factors, including the bank’s robust quarterly earnings, strategic initiatives to enhance operational efficiency, and favorable macroeconomic indicators in the banking sector.

In its latest earnings report, IDBI Bank disclosed a net profit of INR 1,300 crore for Q2 FY2023, which was a significant jump from the previous quarter. This strong financial performance has instilled confidence among investors, thereby driving demand for its shares. Furthermore, the government’s continued support for financial institutions during economic recovery has further buoyed investor sentiment.

Market Factors Influencing IDBI Share Price

Several external factors are also influencing the IDBI share price. The Reserve Bank of India’s recent monetary policy stance, which includes a cautious approach towards interest rates, is critical. A stable interest rate environment tends to benefit banks by improving their lending margins and encouraging borrowing.

Additionally, global market trends, including foreign direct investment and changes in international economic policies, have a trickle-down effect on the Indian banking sector. Recent news about easing inflation has had a positive impact on market liquidity, indirectly benefiting bank stocks, including IDBI.

Conclusion

As investors continue to monitor IDBI’s share price, it is essential to consider the broader economic context and the bank’s strategic direction. With analysts predicting moderate growth for the banking sector in the upcoming quarters, IDBI shares may continue to display volatility but also potential for upward movement. For shareholders and potential investors, keeping an eye on upcoming financial results and regulatory changes will be imperative, as they could significantly influence IDBI’s stock trajectory in 2024 and beyond.