Zomato Share: Recent Trends and Market Performance

Introduction

Zomato Limited, the food delivery giant, has become a key player in the Indian stock market since its IPO in July 2021. As an influential name in the food tech sector, its stock performance is closely monitored by investors and analysts alike. The company’s share price movements often reflect broader trends within the e-commerce and food delivery industries, making it a vital subject for those interested in market dynamics and investment opportunities.

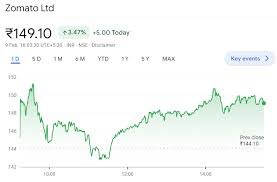

Recent Market Performance

As of September 2023, Zomato’s share price has experienced notable fluctuations. Following a surge in its stock value earlier this year, several factors have contributed to its current price instability. Zomato’s shares peaked at ₹160 in late April, largely driven by positive quarterly results and expanding market share. However, by early September, the stock had dipped to approximately ₹90, reflecting broader market trends, competitive pressures from rivals like Swiggy, and concerns regarding profit margins amidst rising operational costs.

Influencing Factors

Several elements are impacting Zomato’s share performance. First, the potential impact of increasing competition in the food delivery space, particularly from new entrants and existing rivals, is creating a challenging environment for Zomato. Additionally, investors are keeping a close eye on its profitability and ability to scale effectively. While the company’s revenue growth has been promising, ongoing losses have raised questions about sustainable profitability.

Another contributing factor is the recent changes in Indian government policies regarding food delivery services and taxation that might influence business operations and cost structures. Investors are particularly focused on how effectively Zomato can navigate these challenges while continuing to innovate and enhance user experience.

Outlook and Conclusion

Looking forward, analysts suggest that Zomato’s share price could see a recovery if the company can demonstrate consistent financial performance and address profitability concerns. With the festive season approaching, there are opportunities ahead for consumer spending in food delivery services, which might positively impact Zomato’s business. Furthermore, strategic investments and partnerships could bolster Zomato’s market position and revitalize investor confidence.

In conclusion, while Zomato’s share has faced significant challenges recently, investor sentiment might shift positively with the right operational strategies. For investors, this volatility presents both risks and potential opportunities, underscoring the importance of staying informed about market trends and company performance.