Zomato Share: Market Trends and Future Insights

Introduction

Zomato, one of India’s leading online food delivery services, has been a focal point in the stock market since its IPO in July 2021. As the company continues to evolve in the competitive food tech industry, understanding its share performance is crucial for investors and industry watchers alike. With the ongoing shifts in consumer behavior, particularly post-pandemic, tracking Zomato’s stock performance remains significant for gauging the food delivery sector’s trajectory.

Current Market Performance

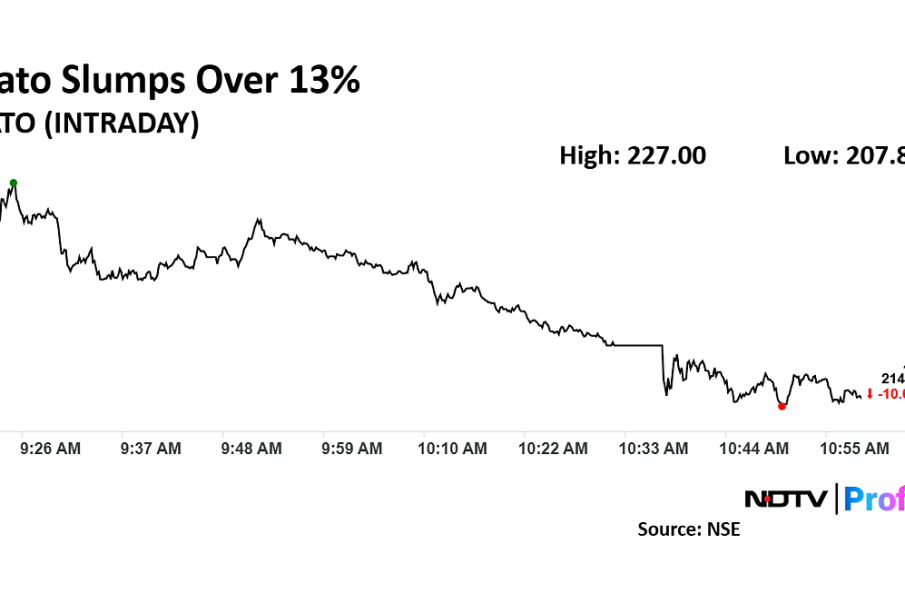

As of October 2023, Zomato’s shares have experienced fluctuations reflective of broader market trends and internal company developments. After reaching a high of ₹150 per share earlier this year, recent reports indicate a slight dip, bringing the current price to around ₹130. Analysts attribute this volatility to increased competition from rivals like Swiggy and new entrants in the market. Moreover, investor sentiment was impacted by global market conditions, influencing technology and food delivery stocks.

Key Developments Affecting Zomato

Several factors contribute to the current performance of Zomato’s shares. Firstly, the company’s venture into grocery delivery services marks an important strategic shift, capitalizing on the growing trend of quick commerce. Recent quarterly results showed a significant increase in revenue, up by 20% year-on-year, although operational losses were reported, raising concerns among investors about profitability.

Moreover, Zomato’s acquisition strategy, including buying out smaller startups to expand its service offerings, is another factor to consider. While these moves are designed to enhance service and market share, they come with the financial burden that can affect short-term stock performance.

Conclusion and Future Insights

The importance of monitoring Zomato’s share performance cannot be overstated, given its role as a barometer for the food delivery industry in India. As the sector adapts to new consumer preferences and competitive pressures, investors will be keenly watching Zomato’s upcoming quarterly results and any strategic announcements the company may make.

Looking ahead, analysts predict that Zomato’s shares may stabilize as the company continues to improve its operational efficiency and respond to market demands. The increasing integration of technology in operations, alongside strategic partnerships, positions Zomato well to navigate market fluctuations. For potential investors, staying informed on Zomato’s developments will be critical for making educated investment decisions.