What You Need to Know About Nifty Expiry Day

Introduction

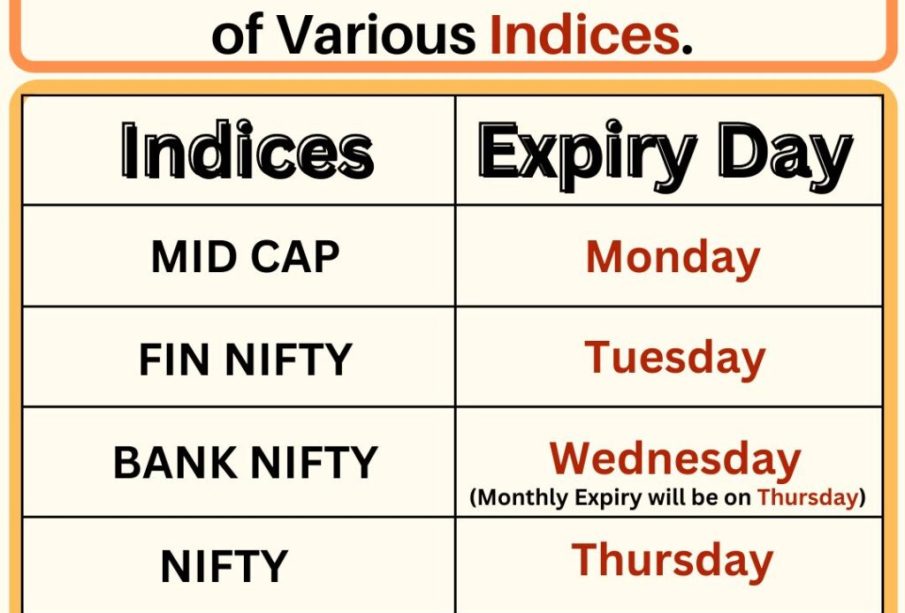

Nifty Expiry Day, typically occurring on the last Thursday of each month, marks the expiration of derivative contracts on the National Stock Exchange (NSE) in India. This event holds significant importance in the stock market as it influences liquidity, volatility, and trading strategies among investors. Understanding the dynamics of Nifty Expiry Day can empower traders to make informed decisions and potentially enhance their trading performance.

The Significance of Nifty Expiry Day

On Nifty Expiry Day, traders focus on various derivatives, including futures and options, that expire at the end of each month. This day often sees increased trading volumes and price fluctuations as investors adjust their positions, unwinding old contracts and establishing new ones. Typically, the last hour of trading can witness heightened activity, with speculative trading becoming commonplace.

Recent Trends and Data

As of October 2023, volatility in the Nifty index tends to spike around expiry, often leading to traders making last-minute adjustments to hedge their portfolios. According to market analysts, the average trading volume on Nifty Expiry Day has increased by over 20% in recent months, pointing towards heightened investor engagement. Additionally, historical patterns reveal that approximately 70% of the time, the market experiences a price correction in the last hour, indicating the presence of strong last-minute trading strategies.

Strategies for Traders

On Nifty Expiry Days, it is advisable for traders to formulate solid strategies tailored to the prevailing market conditions. Some popular strategies include:

- Hedging: Using options to limit potential losses.

- Scalping: Taking advantage of short-term fluctuations for quick profits.

- Trend Following: Identifying and following price trends throughout the day.

Conclusion

Nifty Expiry Day is a critical juncture for traders, offering both opportunities and risks. Knowledge of market behaviors can help investors navigate potential pitfalls and capitalize on the market’s volatility. With ongoing trends showing increased participation and more sophisticated trading strategies being adopted, traders must stay informed to make the most of this vital aspect of the Indian stock market. As we approach the next expiry day, the anticipation grows, promising both challenges and chances for astute investors.