What to Expect from the Fed Meeting on Interest Rates

Introduction: Why the Fed meeting on interest rates matters

The Federal Reserve’s meeting on interest rates is a central event for global financial markets, borrowers and policymakers. Decisions or signals from the Fed influence borrowing costs, mortgage rates, currency values and investor expectations. Given the Fed’s role in targeting stable prices and maximum employment, its guidance on interest rates is highly relevant to businesses, households and international markets.

Relevance for readers

Consumers watch the Fed for its effect on loan rates and savings returns; businesses plan investment and hiring around borrowing costs; and investors reprice risk and returns across equities, bonds and currencies. Even without an immediate policy change, the Fed’s communication can shift market sentiment.

Main body: Key issues and likely focal points

Economic indicators under review

At the meeting, Fed officials typically consider measures of inflation, labor market strength and economic growth. Inflation indicators and wage trends inform the Fed on price pressures, while unemployment and payroll reports show labor market tightness. The Fed also monitors consumer spending and business investment as signs of broader demand.

Possible policy paths and market reaction

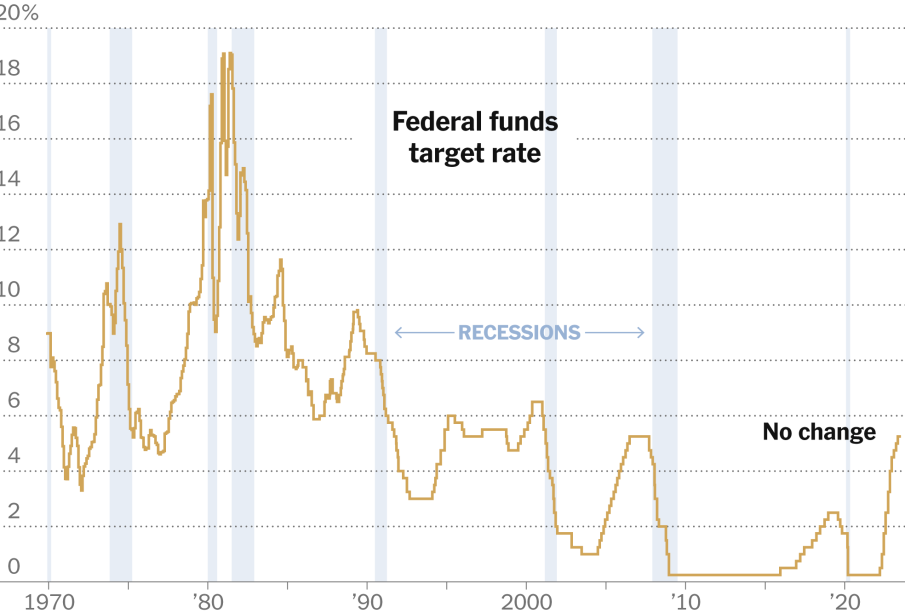

The Fed can choose to hold rates steady, signal a future hike or indicate a move toward easing, depending on the balance of inflation and employment data. Markets often react quickly: bond yields may move, equities can fluctuate, and the dollar may strengthen or weaken. Mortgage and corporate borrowing costs are sensitive to these shifts.

Communication and forward guidance

Beyond the immediate decision, the Fed’s statement, projections (such as the dot plot) and press conference provide guidance on the likely path of policy. Clarity or ambiguity in messaging can increase or dampen market volatility.

Conclusion: What readers should take away

The Fed meeting on interest rates will shape short-term financial conditions and influence medium-term economic expectations. While any specific action depends on evolving data, readers should prepare for potential market volatility and assess household and business budgets in light of possible changes to borrowing and saving costs. Longer term, the Fed’s stance will affect inflation trajectories and employment prospects—making attentive reading of the Fed’s signals important for financial planning and risk management.