Waaree Renewables Share Price Trends: What Investors Need to Know

Introduction

Waaree Renewables, one of India’s leading solar energy companies, has been making headlines recently due to fluctuations in its share prices. As the renewable energy sector gains traction in India, understanding the trends and shifts in Waaree’s share price becomes crucial for potential investors and market analysts. The performance of such companies can significantly impact India’s journey towards sustainable and renewable energy sources.

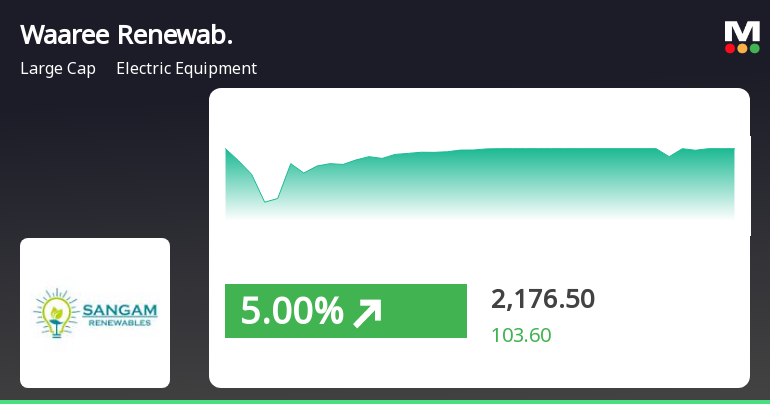

Recent Share Price Performance

As of October 2023, Waaree Renewables’ stock has seen various ups and downs, reflecting both company-specific developments and broader market conditions. The company reported a share price of approximately ₹485 per share on October 15, 2023, a notable decrease of 5% from the previous month. This decline can be attributed to increased competition in the solar sector and fluctuations in raw material prices, including polysilicon, which is essential for solar panel production.

Despite this recent dip, analysts remain optimistic about the long-term prospects of Waaree Renewables. They point out that the company recently secured several high-profile contracts, including a deal to supply solar panels for government projects across multiple states. These developments indicate a robust order book, which could bolster future revenue and investor confidence.

Market Trends Influencing Share Prices

The renewable energy sector is influenced by various factors, including government policies, international trends, and technological advancements. The Indian government has set ambitious targets for renewable energy generation, aiming for 450 GW by 2030. This positive regulatory environment is expected to benefit established players like Waaree Renewables in the coming years.

Moreover, the global shift towards green energy and sustainability is leading to a surge in investments in the renewable sector. Notably, companies like Waaree are likely to see increased interest from both domestic and foreign investors, particularly as ESG (Environmental, Social, and Governance) criteria become more prevalent in investment decisions.

Conclusion

In summary, while the current share price of Waaree Renewables has experienced some fluctuations, the long-term outlook remains positive. The company’s strong market position and strategic partnerships are expected to strengthen its performance as the renewable energy market continues to grow. For investors looking to enter this sector, keeping an eye on Waaree Renewables’ share price and market developments will be essential for making informed decisions.