VEDL Share Price: Recent Trends and Insights

Introduction

The share price of Vedanta Limited (VEDL) has been a focal point of interest among investors and market analysts due to the company’s significant role in the mining and metals sector. Understanding the fluctuations in VEDL’s share price is crucial for both current and potential investors as it reflects the company’s performance, market sentiment, and broader economic conditions.

Recent Performance

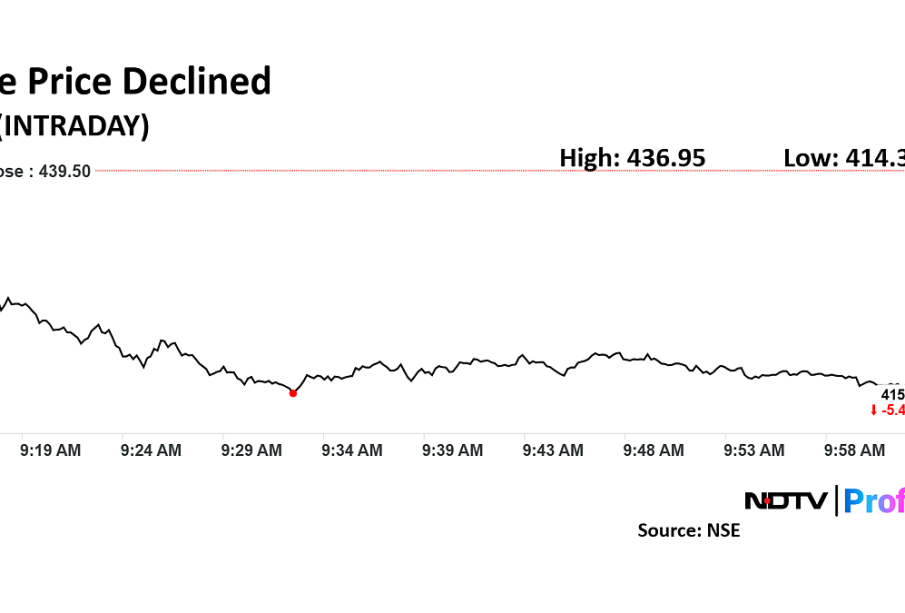

As of mid-October 2023, VEDL’s share price has experienced notable volatility. Recently, the stock was trading at ₹304, reflecting a slight decline from its previous highs. This dip can be attributed to various factors including global market trends, commodity prices, and regulatory news affecting the mining sector.

Market Influences

The fluctuations in VEDL’s share price are influenced by several macroeconomic factors. For instance, changes in the prices of key commodities such as aluminum and zinc, which constitute a major portion of VEDL’s revenue, directly impact its share valuation. Additionally, ongoing geopolitical tensions and economic policies in India and globally have created uncertainties in the market.

Analyst Opinions

Market analysts remain divided on VEDL’s future. Some suggest that the stock has strong potential for recovery due to the expected demand increase for metals in various industries, especially with upcoming infrastructure projects in India. Others remain cautious, highlighting the risks associated with volatility in global commodity markets and domestic regulatory challenges. Analysts have set a target price ranging from ₹320 to ₹350 for VEDL depending on recovery patterns in the global economy.

Conclusion

In conclusion, VEDL’s share price is a critical indicator of not just the company’s financial health but also the status of the broader mining and metals industry. For investors, understanding the dynamics influencing VEDL’s share price can provide valuable insights into making informed decisions. As the market evolves, keeping an eye on commodity price trends, company announcements, and overall economic conditions will be essential for anyone considering investing in Vedanta Limited.