USD to INR Exchange Rate: Latest Trends and Insights

Importance of the USD to INR Exchange Rate

The USD to INR exchange rate is a critical indicator of the economic relationship between India and the United States. It impacts trade, investments, and overall economic policy. As the economy gradually navigates through the complexities of the post-pandemic recovery, understanding the fluctuations of this exchange rate has become essential for businesses, investors, and consumers alike.

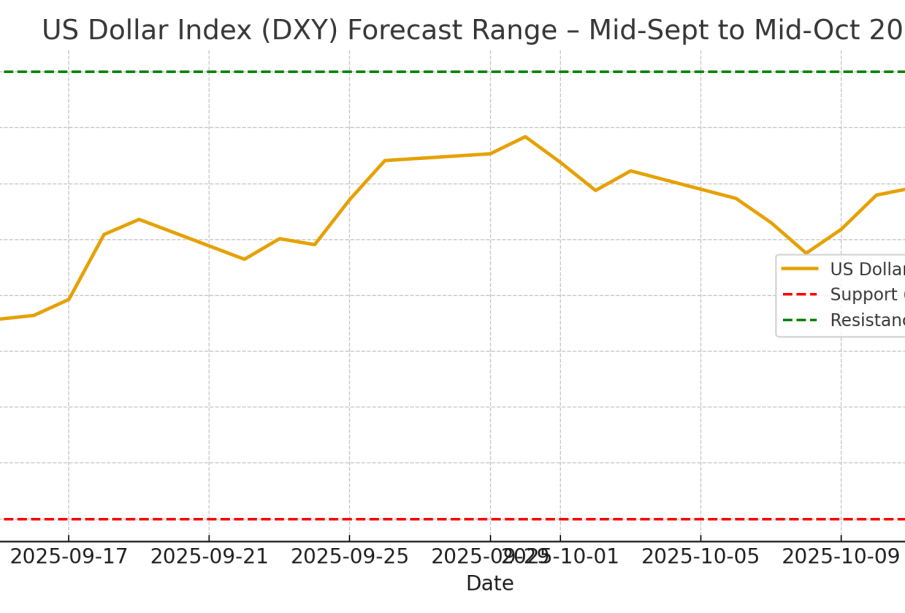

Current Trends in the Exchange Rate

As of October 2023, the USD to INR exchange rate shows a notable trend with the Indian Rupee (INR) currently facing pressures from global market dynamics and domestic inflation rates. Recently, the INR has depreciated slightly against the USD, with rates hovering around 82.50 INR for 1 USD. This depreciation is attributed to various factors including the strengthening of the US dollar due to the Federal Reserve’s interest rate hikes aimed at combating inflation.

Factors Influencing the Exchange Rate

Several key factors influence the USD to INR exchange rate:

- Inflation Rates: High inflation in India can lead to a depreciation of the Rupee as purchasing power erodes.

- Interest Rate Differentials: The decisions made by central banks regarding interest rates significantly affect the flow of foreign investments and currency strength.

- Geopolitical Events: Regional stability and trade agreements can lead to increased investor confidence or fear, impacting the currency valuation.

- Global Market Sentiments: Overall economic health in emerging markets versus developed markets dictates flows of investment into these currencies.

Significance for Businesses and Consumers

The fluctuations of the USD to INR exchange rate have far-reaching implications. For businesses that import goods, a weaker Rupee can increase costs, leading to potential price hikes for consumers. Conversely, Indian exporters may benefit from a weaker Rupee as their goods become cheaper for foreign buyers. Consumers planning to travel abroad or make online purchases in USD should also be aware of these trends as it directly affects their spending power.

Conclusion

As we move into the latter part of 2023, the exchange rate between the USD and the INR is expected to remain volatile, influenced by a mix of domestic economic policies, geopolitical tensions, and global monetary trends. Stakeholders, from policymakers to everyday consumers, must keep a close watch on these developments to better navigate the economic landscape. The forecasting for the future suggests that strengthening of the Rupee may be contingent on stabilized inflation and monetary support, as well as international trade agreements that boost economic confidence.