UPL Share Price: Current Trends and Future Outlook

Introduction

The share price of UPL Limited, a leading global player in the agrochemical sector, has garnered significant attention among investors and financial analysts. Understanding the fluctuations in its stock price is crucial not only for potential investors but also for stakeholders within the agricultural industry. As markets globally adjust to economic conditions, the performance of UPL’s shares is indicative of both investor sentiment and broader agricultural business trends.

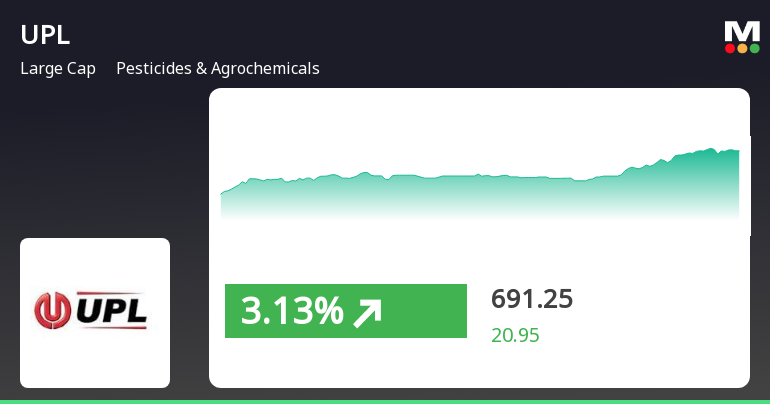

Recent Performance

As of late October 2023, UPL’s share price has experienced notable volatility. After peaking at ₹840 earlier this month, the stock faced a correction, trading around ₹805. Market analysts attribute this dip to various factors, including changes in global commodity prices and currency fluctuations that impact UPL’s export-dependent revenue. Furthermore, the recent earnings report indicated a small decline in profit margins, which may have contributed to the cautious outlook among investors.

Market Factors Influencing Share Price

Several external factors are currently influencing the share price of UPL. The ongoing geopolitical tensions affecting grain exports and the impact of climate change on crop yields are pivotal considerations for the agrochemical industry. In addition, regulatory changes in pesticide use in key markets have created challenges. Analysts are keeping an eye on UPL’s response to these challenges, particularly its investment in sustainable agricultural solutions, which could positively affect future earnings.

Expert Opinions

Financial experts remain cautiously optimistic about UPL’s long-term growth. Analysts from leading financial institutions suggest that UPL’s diversification into newer markets and product lines will fortify its position in the global agrochemicals market, potentially driving the share price up in the future. Forecasts from various brokerage houses suggest that if UPL can navigate current market conditions effectively, its share price could rebound significantly, with target prices set as high as ₹950 in the coming quarters.

Conclusion

In conclusion, while the current share price of UPL Limited is subject to various market fluctuations and pressures, its fundamentals remain strong. Stakeholders are advised to closely monitor market trends and the company’s strategic moves, especially in sustainability and market expansion. The agrochemical sector is poised for growth, and UPL’s agile adaptation to market demands may lead to a significant recovery in its share price in the near future.