Updates on Vodafone Share Price: Trends and Analysis

Importance of Monitoring Vodafone Share Price

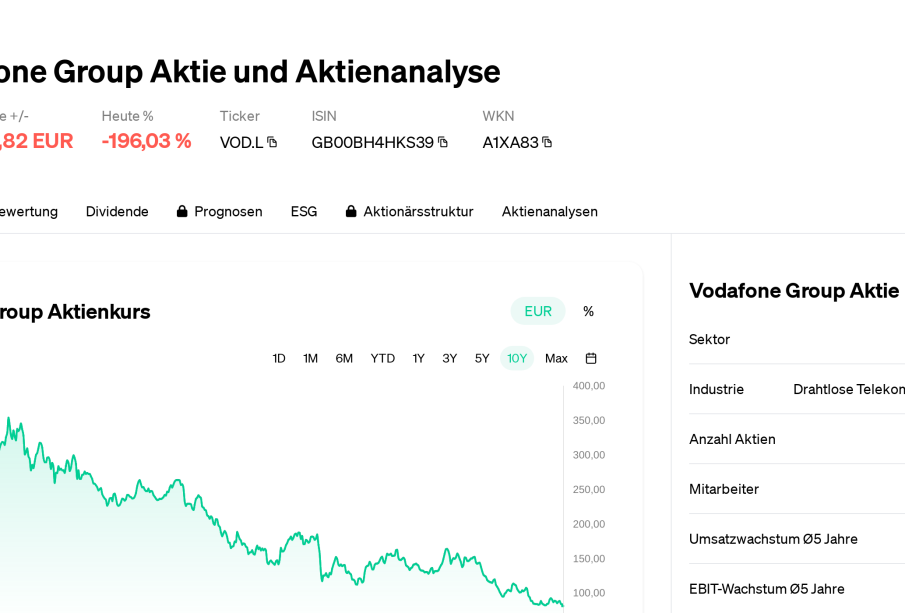

As one of the leading telecommunications companies globally, Vodafone’s share price is closely watched by investors and market analysts alike. Understanding the factors that influence its stock price is crucial for making informed investment decisions. In recent weeks, fluctuations in Vodafone’s share price have been indicative of broader economic trends and company performance.

Recent Performance

As of October 12, 2023, Vodafone’s share price stands at ₹130, reflecting a 3% increase from the previous week. This uptick follows news of a partnership with a prominent technology firm, aimed at enhancing their 5G network offerings. Analysts believe that this strategic move not only positions Vodafone as a key player in the telecommunications sector but also stabilizes investor confidence.

Market Influences

Several factors have influenced the recent price movements of Vodafone shares. Firstly, the ongoing global supply chain issues have had a significant impact on production costs and service delivery, prompting concerns among investors. However, Vodafone’s proactive measures in managing these challenges have been noted positively in the market.

Secondly, the telecommunications regulatory environment in Europe poses both challenges and opportunities. With the European Commission pushing for fair competition, Vodafone’s initiatives to improve customer service and service offerings have garnered positive attention. This is expected to keep the share price resilient amidst regulatory pressures.

Future Outlook

Looking forward, market analysts suggest that Vodafone’s share price may continue to experience volatility due to fluctuating market conditions and competitive pressures. However, with the impending rollout of their advanced 5G services, there is optimism about potential revenue growth in the upcoming quarters. Industry experts believe that if Vodafone can successfully implement its growth strategies, share prices could rally in response.

Conclusion

In conclusion, staying attuned to Vodafone’s share price is essential for investors navigating the dynamic telecom market. With ongoing investments in technology and improvements in service delivery, Vodafone appears well-positioned for growth. As market dynamics continue to evolve, those interested in Vodafone’s shares should keep a close watch on economic indicators and company updates.