Update on Waaree Renewables Share Price

Introduction

Waaree Renewables, a leader in the Indian solar energy sector, has garnered significant attention due to its innovative products and commitment to sustainability. The company’s share price has become a focal point for investors and market analysts, reflecting the growing interest in renewable energy solutions amid global climate concerns.

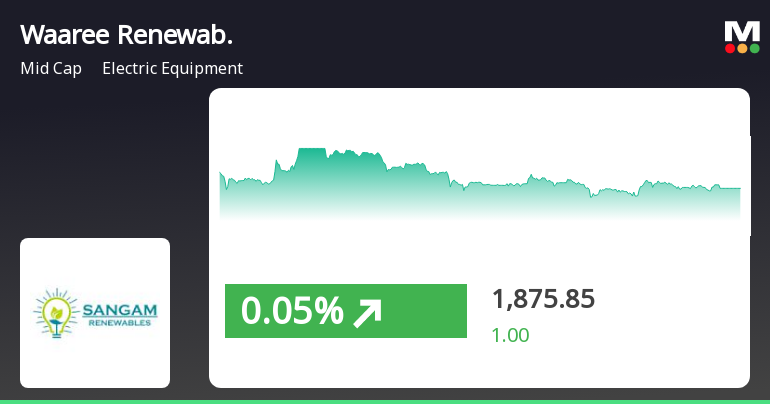

Current Share Price Overview

As of October 2023, Waaree Renewables’ share price has shown a promising upward trend, currently trading at INR 550 per share, up by 5% from the previous month. This rise can be attributed to several factors, including increased demand for solar panels, expansions in international markets, and favorable government policies supporting renewable energy initiatives. In the last quarter, the company reported a revenue growth of 25%, signaling robust operational performance.

Market Context

The renewable energy sector in India is experiencing unprecedented growth, with the government setting ambitious targets for solar energy adoption. Waaree Renewables has positioned itself strategically within this landscape, leveraging its manufacturing capabilities and innovative technology. The company has also secured several large contracts, contributing positively to its stock performance.

Recent Developments

Recently, Waaree announced the launch of its new solar module production facility in Gujarat, expected to increase its output capacity by 1 GW per year. This expansion is anticipated to further enhance the company’s market position and lead to more competitive pricing. Analysts predict that such moves will likely have a positive impact on the company’s share price in the long term.

Investor Sentiment

Investor sentiment around Waaree Renewables remains bullish, with many financial analysts revising their forecasts higher following the latest earnings report. Institutional investors have also increased their holdings in the company, driven by a growing belief in the long-term viability and profitability of the renewable energy sector.

Conclusion

In conclusion, Waaree Renewables’ share price appears set for sustainable growth as the company continues to expand its operations and take advantage of the global shift towards renewable energy. As governments worldwide, including India’s, enforce stricter climate policies and promote clean energy investments, Waaree stands to benefit significantly. Investors looking for long-term gains in the renewable sector should keep a close eye on Waaree’s developments, as the share price is poised for further appreciation in line with sector growth.