Union Bank Share Price: Latest Trends and Insights

Introduction

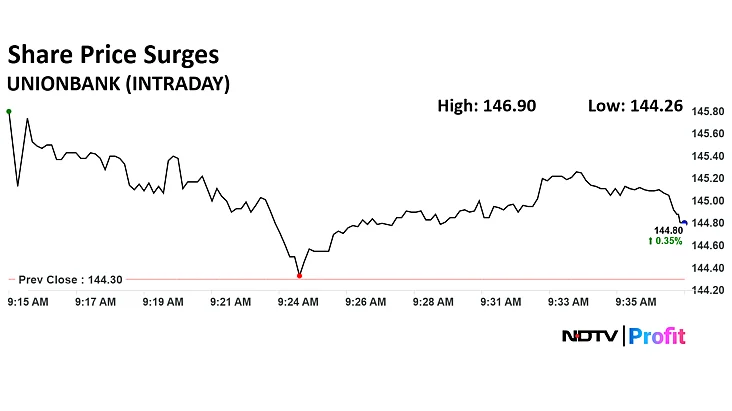

The share price of Union Bank of India has become a focal point for investors following its recent performance in the stock market. As a major player in the Indian banking sector, fluctuations in its share price can significantly affect investor confidence and market dynamics. Understanding these trends is crucial for stakeholders looking to make informed investment decisions.

Current Market Trends

As of mid-October 2023, Union Bank’s share price has shown a responsive behavior to both market fluctuations and economic indicators. Recent data shows that the share price is hovering around ₹60, which represents a growth of approximately 15% over the last quarter. This rise is attributed to various factors, including improved quarterly earnings, better asset quality, and positive forward guidance provided by the bank’s management during their latest earnings call.

Recent Developments

In the recent past, Union Bank has made headlines for its strategic initiatives aimed at strengthening its financial position. The bank has implemented measures such as technology upgrades and increased lending to priority sectors, which have positively influenced investor sentiment. Additionally, the Reserve Bank of India’s favorable policies regarding interest rates and liquidity have also contributed to the upward movement in Union Bank’s share price.

Analysts are optimistic as the bank reported a notable increase in net profit in its Q2 FY2023 earnings, suggesting that its operations are becoming more efficient. Such profitability boosts confidence among investors.

Market Expert Opinions

Market analysts point out that Union Bank’s recent performance has caught the attention of institutional investors, with several funds increasing their stake in the bank. Sandeep Rathi, a senior analyst at a reputed brokerage firm, stated, “The momentum for Union Bank is likely to continue in the coming months, especially considering the anticipated growth in the Indian economy post-pandemic.” This sentiment resonates with the general outlook for the banking sector, which is expected to benefit from increased lending and consumer spending.

Conclusion

In summary, the current share price of Union Bank reflects a positive trend supported by strong financial results and favorable market conditions. For investors, keeping an eye on the developments surrounding the bank and broader economic indicators will be crucial. As the banking landscape evolves, Union Bank’s share price trajectory could provide valuable insights into the overall health of the Indian banking sector.