Union Bank Share: Insights and Market Trends

Introduction

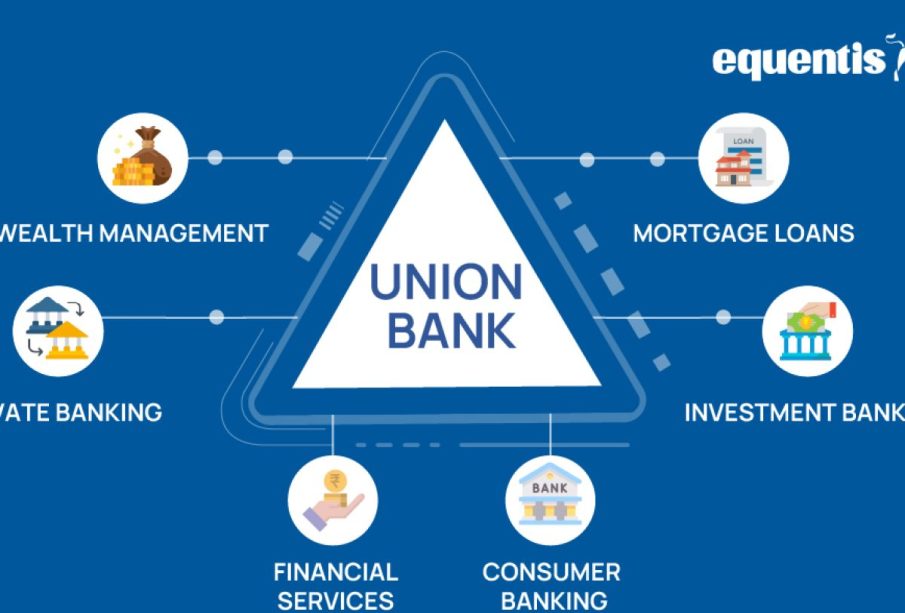

Union Bank of India, one of the prominent public sector banks in the country, has been closely watched by investors and analysts alike, particularly concerning its stock performance. The bank’s shares play a crucial role in the Indian banking sector, reflecting not just the financial health of the institution but also the broader economic indicators affecting the banking industry. As of October 2023, recent market fluctuations and the bank’s strategic initiatives have drawn attention to its share performance.

Current Performance of Union Bank Shares

In recent weeks, Union Bank shares have shown a notable upward trend. As of October 20, 2023, the stock was trading at approximately ₹100, rising over 15% in the last month. This increase can be attributed to various factors, including improved financial results disclosed in the bank’s latest quarterly earnings report. The bank reported a 20% year-on-year growth in net profit, driven by higher net interest income and a reduction in bad loans, a promising sign for investors.

Market Factors Influencing Share Performance

The surge in Union Bank’s share price is also linked to several market dynamics. With the Reserve Bank of India’s recent monetary policy keeping interest rates steady, banks, including Union Bank, are positioned to benefit from a stable borrowing environment. Moreover, the increase in retail loans and a surge in digital banking initiatives have strengthened the bank’s market position and its share value.

Additionally, investors have reacted positively to Union Bank’s strategic focus on digital transformation, which is expected to enhance customer experience and operational efficiency. The bank’s commitment to technology, including the launch of a new mobile banking app, has been well-received, further boosting investor confidence.

Conclusion

Overall, Union Bank shares present an intriguing opportunity for investors looking to capitalize on the banking sector’s recovery in India. The combination of strong financial performance, positive market conditions, and a strategic focus on innovation positions Union Bank as a competitive player. However, potential investors should remain vigilant, as market volatility and economic changes could impact share performance. Continuous monitoring of the bank’s strategies and market conditions will be essential for making informed investment decisions in the coming months.