Understanding the USD INR Exchange Rate: Current Trends and Future Outlook

Introduction

The exchange rate between the US dollar (USD) and the Indian rupee (INR) is a critical indicator of the economic relationship between the United States and India. With globalization accelerating trade and investment, understanding the fluctuations in this exchange rate is essential for businesses, investors, and policymakers alike. In recent months, the USD INR exchange rate has shown significant activity, reflecting broader economic trends and global events.

Current Trends in USD INR Exchange Rate

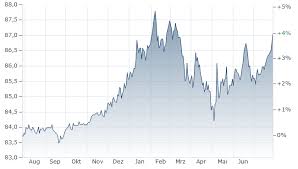

As of October 2023, the USD INR exchange rate has been experiencing volatility due to a combination of factors including geopolitical tensions, domestic economic performance, and global financial policies. The rate has fluctuated between 82 to 85 rupees per dollar. The Reserve Bank of India (RBI) has implemented measures to stabilize the rupee, but external pressures such as crude oil prices and inflationary tendencies have continued to affect its value.

Inflation and its Impact

Inflation rates in India have also been a significant determinant of the USD INR rate. As inflation pressures the purchasing power of the INR, the currency tends to depreciate against the USD. In September 2023, India reported an inflation rate of 6.3%, exceeding the RBI’s comfort level, which has led investors to seek safety in the dollar.

Geopolitical Influences

Geopolitical factors, including tensions in regions such as Eastern Europe and ongoing trade negotiations, have been impacting investor sentiment globally. Investors often flock to the stability of the US dollar in uncertain times, resulting in increased demand and higher rates against other currencies, including the INR.

Future Outlook

Looking forward, analysts predict that the USD INR exchange rate is likely to remain volatile amidst both domestic and international economic developments. The RBI’s stance on interest rates and its interventions in the currency market will play crucial roles in determining the trajectory of the rupee against the dollar. Moreover, global economic recovery trends, especially in the post-pandemic context, will also heavily influence the exchange rate.

Conclusion

For businesses and investors operating in India and globally, keeping an eye on the USD INR exchange rate is crucial for strategic planning. Understanding the variables affecting this exchange rate can provide insights into market trends and help in mitigating risks related to foreign exchange fluctuations. As economic conditions evolve, the significance of monitoring the USD INR exchange rate cannot be overstated, making it a key economic indicator in the coming months.