Understanding the Small Cap Index: Performance & Trends

Importance of the Small Cap Index

The Small Cap Index is critical for investors and analysts as it tracks the performance of small-cap stocks, which generally have a market capitalization of less than Rs 5,000 crore. These stocks can provide significant growth opportunities despite their inherent volatility compared to large-cap counterparts. Understanding the Small Cap Index is vital for investors looking to diversify their portfolios and capitalize on emerging market trends.

Current Market Trends

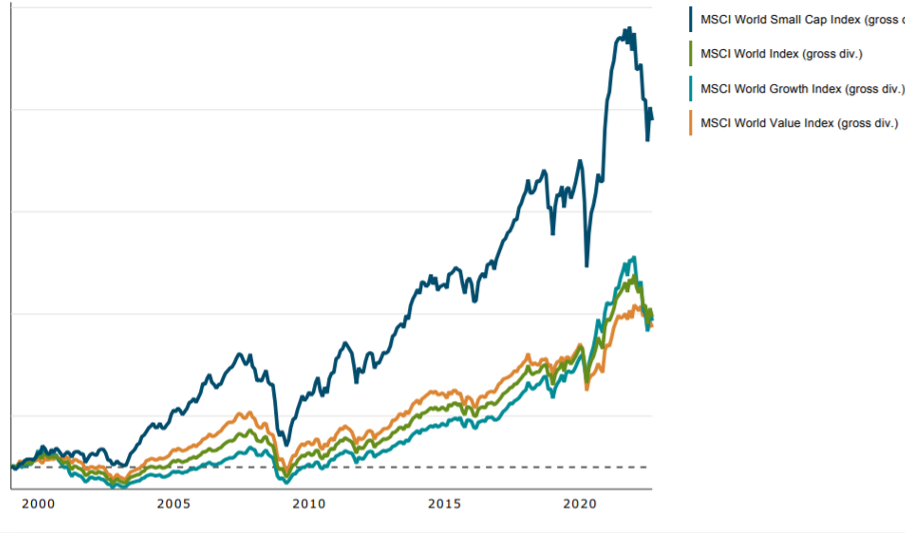

As of late 2023, the Small Cap Index has been showing a positive trajectory, recovering from market corrections witnessed earlier in the year. Recent data indicates that small-cap stocks have outperformed large-cap stocks, driven by strong earnings reports and investor enthusiasm towards smaller firms that are innovating rapidly.

For example, in September 2023, the Nifty Small Cap 100 Index rose by approximately 12% reflecting growing investor confidence amid favorable government policies that nurture small enterprises. Analysts attribute this growth to sectors such as technology, healthcare, and green energy, which have shown resilience and generated robust employment opportunities.

Investment Insights

Investing in small-cap stocks often comes with a higher risk, but the Small Cap Index suggests a rewarding potential for those willing to take the plunge. Investors are advised to conduct thorough due diligence when venturing into this segment, focusing on company fundamentals, market conditions, and sectoral trends. Furthermore, small caps tend to have greater upside potential as they can be more agile in adapting to market changes and consumer demands.

Conclusion

The Small Cap Index remains an essential benchmark for investors keen on exploring growth opportunities in the Indian stock market. With ongoing economic recovery and innovation at the forefront, the small-cap space appears ripe for investment. As the market evolves, continuing to monitor the Small Cap Index will be crucial for making informed investment decisions. The outlook for small-cap stocks suggests a positive trend, making now an opportune time for investors to assess their portfolio strategies and consider small-cap investments for long-term growth.