Understanding the Small Cap Index and Its Market Implications

Introduction to the Small Cap Index

The Small Cap Index is a significant indicator in the world of stock market investing, especially for those focusing on emerging companies with smaller market capitalizations. As investors seek opportunities beyond large-cap stocks, understanding the Small Cap Index becomes crucial for informed decision-making. This index represents companies with a market cap typically ranging from $300 million to $2 billion and serves as a barometer for the performance of the broader economy, reflecting increased risk and potential rewards associated with small- to mid-sized businesses.

Recent Trends in the Small Cap Index

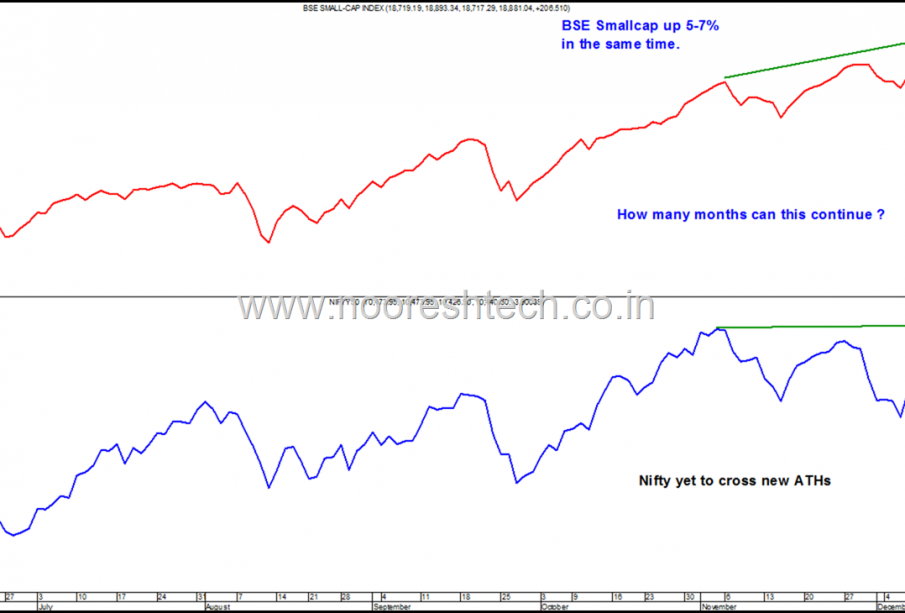

As of October 2023, the Indian Small Cap Index has shown noteworthy resilience despite market volatilities. Recent trends indicate a robust performance with a reported year-to-date increase of approximately 15%. Factors contributing to this growth include improving economic conditions, policies favoring MSMEs (Micro, Small, and Medium Enterprises), and increased retail investor participation in the stock market.

Moreover, sectors such as technology, healthcare, and consumer goods have particularly benefitted small-cap firms. According to a report by the National Stock Exchange, small-cap companies have been outpacing their larger counterparts due to innovative business models and adaptability in changing economic landscapes.

Challenges Faced by Small Cap Companies

Despite their growth, small-cap companies encounter various challenges, including limited access to capital, market volatility, and regulatory hurdles. Many of these firms struggle with scaling operations and maintaining competitive edges against larger corporations. Additionally, during economic downturns, small caps tend to be more sensitive to market shifts, making them riskier investments.

The Future of the Small Cap Index

Looking ahead, analysts suggest a cautiously optimistic outlook for the Small Cap Index. Continued government support and investment in infrastructure are likely to foster growth. However, potential investors should remain vigilant about the inherent risks. Diversification within small-cap holdings can mitigate some of this risk, allowing investors to capitalize on high-growth opportunities while safeguarding their portfolios.

Conclusion

In summary, the Small Cap Index remains an essential element for investors aiming to tap into the dynamic landscape of small to mid-sized companies. With encouraging recent trends and an optimistic outlook, this segment presents substantial opportunities. Nonetheless, awareness of the challenges and market conditions is pivotal for successful investing. Investors are encouraged to conduct thorough research and consider consulting financial advisors when exploring small-cap investments.