Understanding the Sensex Index: Trends and Implications

Introduction

The Sensex Index, also known as the Bombay Stock Exchange Sensitive Index, is a major stock market index in India. It comprises 30 of the largest and most actively traded stocks listed on the BSE, making it a key indicator of market performance. Understanding the Sensex is crucial for investors, analysts, and policymakers as it reflects the overall economic health of the country and influences investment decisions.

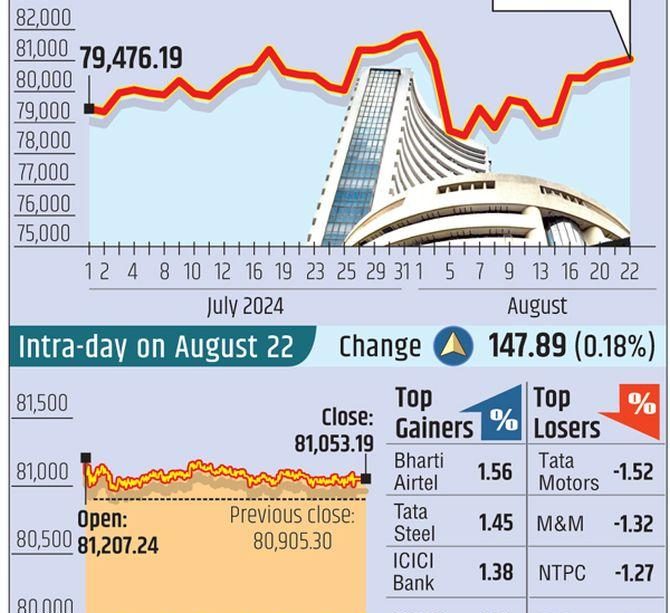

Current Trends in the Sensex Index

As of October 2023, the Sensex has been showing significant resilience despite global market volatility. The index recently reached an all-time high of 68,000 points, propelled by strong corporate earnings and renewed investor confidence. Major sectors contributing to this surge include IT, banking, and consumer goods. The heavy inflow of foreign direct investment (FDI) and positive regulatory reforms have also bolstered the index.

According to the latest reports, the top-performing stocks within the Sensex include large players like Reliance Industries, Tata Consultancy Services (TCS), and HDFC Bank. Analysts attribute their growth to robust quarterly results and strategic expansion plans. Additionally, the implementation of policies aimed at enhancing ease of doing business has attracted more local and foreign investors, further strengthening the index.

Market Sentiment and Economic Factors

Market sentiment plays a pivotal role in the movements of the Sensex index. The recent decisions by the Reserve Bank of India (RBI) regarding interest rates have also influenced investor behavior. With a stable interest rate environment, many investors remain optimistic about the potential for growth in the equities market.

Moreover, economic indicators such as the GDP growth rate and inflation rate serve as background factors affecting the index. Current projections suggest that India’s economy will continue to grow robustly, encouraging investor confidence and potentially leading to further gains in the Sensex index.

Conclusion

In conclusion, the Sensex index is more than just a number; it is a reflection of the economic landscape of India. Current trends show a positive trajectory, fueled by strong corporate earnings and macroeconomic stability. While volatility is inherent in stock markets, continued reforms and investment in crucial sectors are likely to sustain the momentum of the Sensex. For investors, understanding these dynamics can lead to informed decisions in the ever-changing market environment.