Understanding the Sensex Index: Current Trends and Impacts

Introduction to Sensex Index

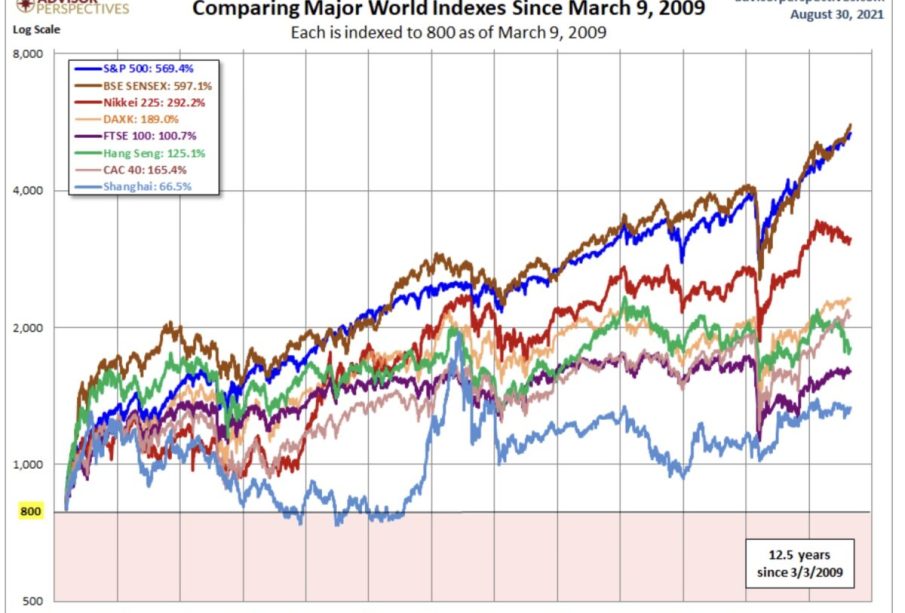

The Sensex Index, also known as the BSE Sensex, serves as a barometer for the Indian stock market, reflecting the health of one of Asia’s largest economies. Established in 1986, it comprises 30 of the largest and most financially sound companies listed on the Bombay Stock Exchange (BSE). The index is significant not only for investors but also for economists and policymakers, as it encapsulates market sentiments and trends.

Current Market Trends

As of October 2023, the Sensex has shown considerable fluctuations, indicative of global economic influences. Recent reports show that the index reached a notable peak of 67,000 points, demonstrating resilience amid rising inflation concerns and geopolitical tensions. Analysts attribute this surge to strong corporate quarterly earnings, improving consumer demand, and effective monetary policies by the Reserve Bank of India (RBI).

In recent weeks, tech stocks have played a pivotal role in driving the index upward, fueled by innovations and a rebound in global markets. Companies like Tata Consultancy Services and Infosys reported stronger-than-expected earnings, attracting domestic and foreign investments.

Factors Influencing the Sensex

Major factors influencing the Sensex Index include global market trends, currency fluctuations, and domestic economic policies. For instance, the RBI’s decision to maintain interest rates has instilled confidence among investors. Additionally, international crude oil prices and trends in the U.S. stock market also bear significant weight on the index.

Furthermore, the upcoming Indian general elections are likely to bring changes in market sentiment. Traders are closely monitoring political developments, as stable governance is often associated with positive market performance.

Conclusion and Future Outlook

The Sensex Index remains a critical indicator of economic health in India. As various factors continue to shape its movement, forecasts suggest potential volatility in the short term due to global economic uncertainties. However, with robust corporate earnings and investor confidence, analysts project a cautious but optimistic outlook for the index over the next quarter.

For investors, staying updated with market trends and understanding the underlying economic indicators will be vital for making informed decisions. The ongoing shifts in the Sensex can offer valuable insights into the broader economic landscape of the country.