Understanding the Sensex Index and Its Economic Significance

Introduction

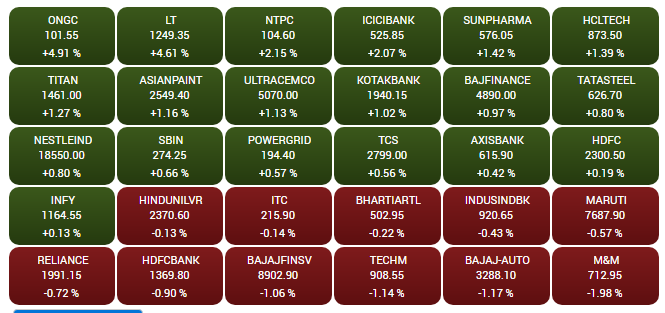

The Sensex Index, officially known as the Bombay Stock Exchange Sensitive Index, is a benchmark index that measures the performance of the top 30 companies listed on the Bombay Stock Exchange (BSE). Understanding the Sensex is crucial, as it serves as an essential indicator of the Indian stock market’s health and overall economic condition. As India continues to grow as a global economic player, fluctuations in the Sensex can have wide-ranging implications for investors and citizens alike.

Recent Developments in the Sensex

As of October 2023, the Sensex has displayed considerable volatility, reflecting various economic indicators, including inflation rates, foreign investments, and global market trends. Recent reports indicate that the Sensex hit a record high of over 66,000 points, driven by strong corporate earnings and increased foreign direct investment. This surge highlights investor confidence in the Indian market and its capacity for growth despite global economic uncertainties.

Furthermore, analysts point out that sectors such as information technology and financial services have been significant contributors to this upward trend. The addition of new technology stocks and sustained demand for digital services has boosted market performance. Additionally, the government’s strategic initiatives aimed at enhancing economic growth and attracting investments have further fueled optimism among investors.

Implications for Investors

For investors, understanding the factors that drive the Sensex Index is vital for making informed decisions. A rising Sensex can indicate a thriving economy, potentially leading to increased investment opportunities. Conversely, declining trends in the index may signal economic challenges, prompting investors to reevaluate their portfolios. It’s also worth noting that the Sensex’s movements are often reflected in mutual fund performance, which can impact individual investors seeking to maximize their returns.

Conclusion

The Sensex Index remains a pivotal component of the Indian financial landscape, reflecting both economic prosperity and investor sentiment. As it reached new heights, the implications for various sectors and investors are significant, underscoring the need to stay informed about market trends. Looking ahead, economists suggest that continued growth in GDP, coupled with supportive government policies, could sustain the upward trajectory of the Sensex. Consequently, both seasoned investors and newcomers should closely monitor the Sensex to navigate the complexities of the Indian stock market effectively.