Understanding the Recent Trends in Protean Share Price

Introduction to Protean Share Price

The stock market is a vital aspect of the global economy, and keeping track of individual company performances can provide insight into broader economic trends. One such company, Protean, has been making headlines recently due to fluctuating share prices. Understanding these movements helps investors navigate their options in the increasingly competitive market.

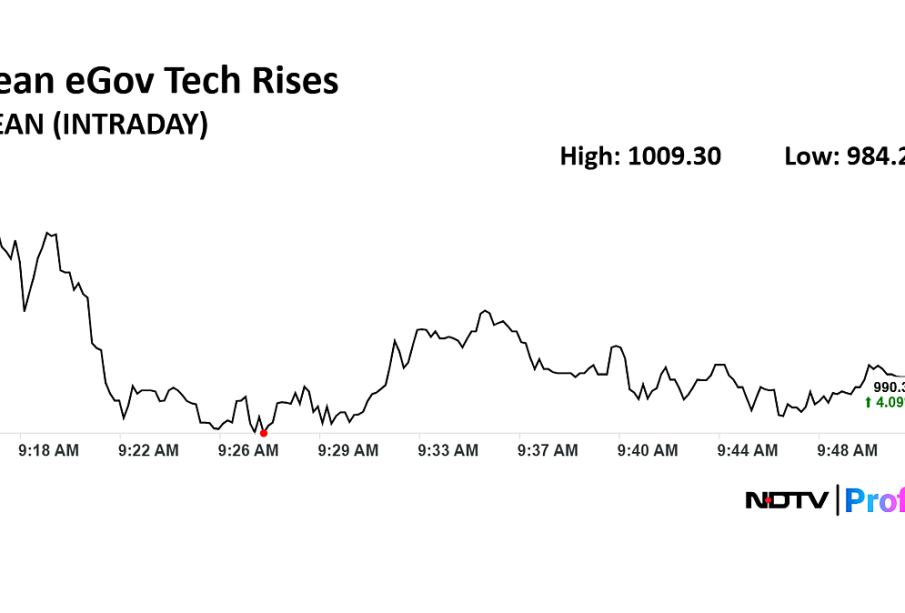

Recent Performance of Protean Shares

As of October 2023, Protean shares have experienced market fluctuations influenced by various internal and external factors, including overall market conditions, sector performance, and company-specific news. Notably, Protean has seen its shares trade in a range of ₹150 to ₹200 over the last few weeks. Analysts have attributed this volatility to recent earnings reports that did not meet investor expectations along with several macroeconomic factors affecting market sentiment.

Factors Influencing the Share Price

1. Company Earnings: Protean’s latest quarterly report showed a decline in net profits compared to the previous quarter, which has raised concerns among investors about future growth potential.

2. Market Conditions: Global uncertainties, including inflation rates and geopolitical tensions, have led to cautious trading behaviors among investors, impacting various stocks including Protean.

3. Sector Trends: As Protean operates in a sector undergoing rapid transformation, competition has intensified, and innovation cycles have shortened, leading to a reevaluation of stock prices based on projected future performance.

Conclusion and Future Outlook

The recent trends in Protean’s share price reflect ongoing challenges and opportunities within the company and the wider market landscape. Investors are advised to monitor upcoming corporate announcements, economic indicators, and market conditions before making investment decisions. While the current outlook may appear uncertain, the long-term trajectory depends on Protean’s ability to adapt and innovate in response to both market pressures and opportunities. Keeping a close eye on future movements and market analysis can aid investors in positioning themselves strategically.