Understanding the Recent Trends in Broadcom Share Price

Introduction

The technology sector has been witnessing significant fluctuations, and the performance of individual stocks can have ripple effects across the market. One such stock is Broadcom Inc., a leader in semiconductor and infrastructure software solutions. Understanding the current trends in Broadcom’s share price is crucial for investors, analysts, and stakeholders looking to navigate the volatile markets.

Current Trends in Broadcom Share Price

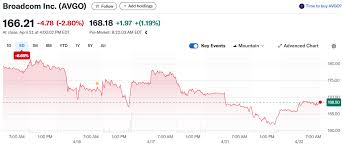

As of mid-October 2023, Broadcom shares have shown a notable increase, trading around $900, marking a substantial rise of approximately 15% over the last month. Analysts attribute this uptick to several factors, including strong earnings reports and increased demand for semiconductors due to advancements in 5G technology and artificial intelligence.

In the latest earnings call, Broadcom reported a revenue increase of 20%, driven by its networking and broadband segments. CEO Hock Tan noted that the company is positioned to benefit from the ongoing digital transformation across various industries. Such robust performance has led to upgraded price targets from multiple financial analysts, with some projecting a potential rise to $950 per share in the coming months.

Market Factors Influencing Share Price

Broadcom’s stock price is significantly influenced by global supply chain conditions, particularly in semiconductor industries. The ongoing geopolitical tensions and disruptions in supply chains have led to concerns regarding availability and production. However, Broadcom’s diversified product portfolio and long-term contracts have helped mitigate some of these risks.

Additionally, interest rates and inflation pose risks to the stock’s future performance. The Federal Reserve’s decisions on interest rates are closely monitored by investors, as they can influence technology stocks’ valuations. A stable rate environment would likely support continued investment in stocks like Broadcom.

Conclusion

The recent trends in Broadcom’s share price reflect a strong performance that may continue as the semiconductor industry expands. Investors should remain vigilant, monitoring economic indicators and market conditions that may impact Broadcom’s operations and stock performance. With advancements in technology driving demand and a solid financial outlook, Broadcom is positioned for growth in the foreseeable future.