Understanding the Recent Trends in BDL Share Price

Introduction

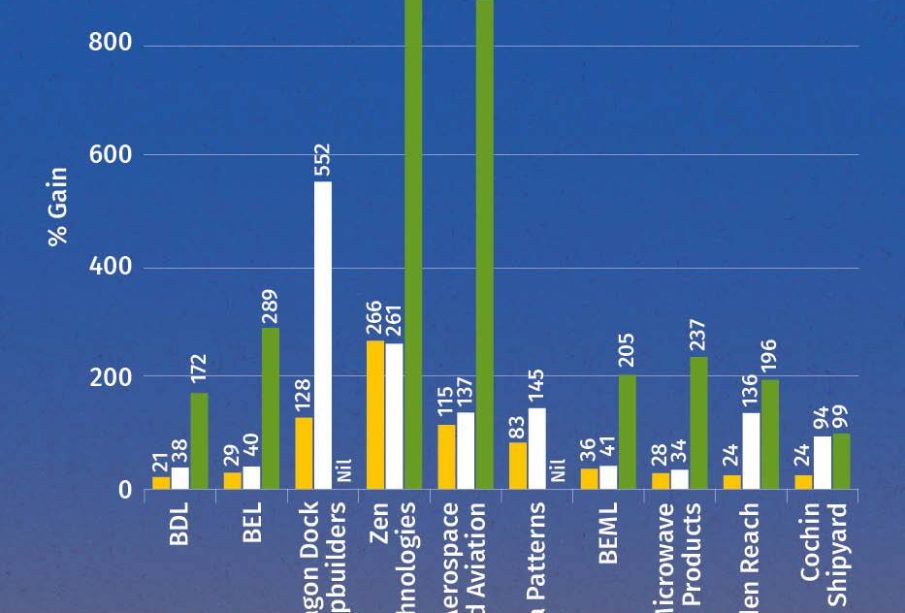

The share price of Bharat Dynamics Limited (BDL) has emerged as a significant focal point for investors navigating the Indian stock market. As a leading manufacturer of defense equipment in India, BDL plays a crucial role in the country’s defense sector. The performance of its shares is often scrutinized, reflecting broader economic trends, government policies, and sector-specific developments. With the rising interest in defense initiatives and the company’s strategic partnerships, understanding BDL’s share price movements has never been more pertinent.

Current Share Price Trends

As of October 2023, BDL shares are trading at approximately ₹620, showcasing a steady increase from the previous month’s average of ₹590. The stock has witnessed fluctuations attributed to various factors including quarterly earnings reports and changes in government defense spending. The latest quarterly report indicated a commendable growth in revenues driven by increased contracts from the Indian Armed Forces, thereby bolstering investor confidence.

Recent Developments Impacting BDL Share Price

Several recent developments have significantly influenced BDL’s market performance. Notably, the Indian government’s push for ‘Atmanirbhar Bharat’ (self-reliant India) has augmented the defense manufacturing sector, directly benefiting companies like BDL. Furthermore, a recent collaboration with global defense technology firms has opened avenues for advanced manufacturing and exports, projecting optimism among shareholders.

Additionally, with the defense outlook becoming more favorable following geopolitical tensions, analysts predict stronger demand for indigenous defense products, providing a further boost to BDL’s financial growth and share price. Market analysts are also closely watching sudden changes in legislation surrounding foreign direct investments in the defense sector, which could impact BDL’s future contracts and share performance.

Conclusion and Forecast

In conclusion, BDL’s share price reflects not only the company’s operational competence but also the broader economic environment in which it operates. The current upward trend, fueled by positive earnings reports and government policies favoring domestic defense production, points towards a promising outlook for investors. Analysts forecast that barring unforeseen economic setbacks, BDL’s share price could see sustained growth over the coming months. As always, investors are encouraged to conduct thorough research and consider market dynamics before making any investment decisions.