Understanding the PF Withdrawal Process in India

Introduction

Provident Fund (PF) is a crucial savings tool for employees in India, managed by the Employees’ Provident Fund Organization (EPFO). The PF scheme serves not only as a retirement plan but also offers financial security during job transitions or emergencies. With increasing employment mobility, knowledge about the PF withdrawal process has become essential for many workers in India.

Eligibility for PF Withdrawal

Employees are eligible to withdraw their PF savings under several circumstances such as retirement, resignation, or if they remain unemployed for more than two months. Additionally, partial withdrawals are allowed for specific reasons like home buying, medical emergencies, or children’s education, subject to certain conditions set by the EPFO.

Steps to Withdraw PF

The process to withdraw PF is simpler, thanks to the digital initiatives by EPFO. Here are the main steps:

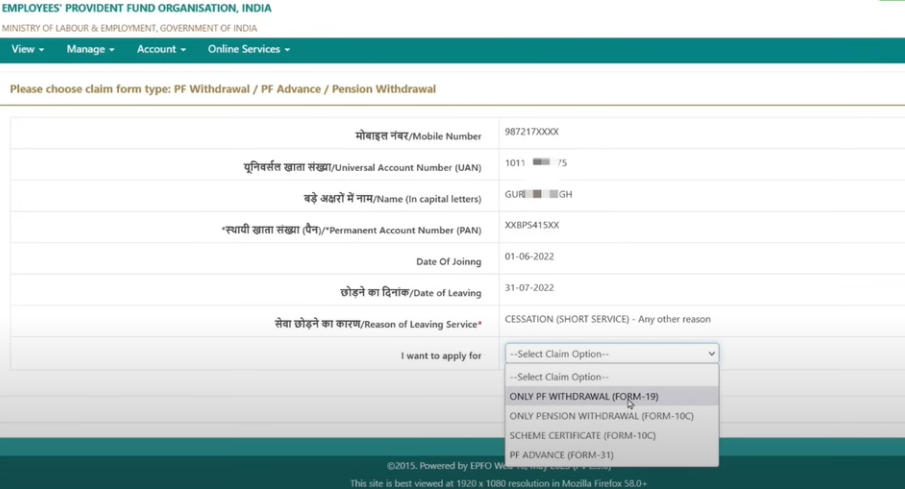

- Step 1: Ensure that your Universal Account Number (UAN) is activated, and your KYC details (Aadhaar, PAN, and bank account number) are verified on the EPFO portal.

- Step 2: Visit the EPFO member portal and log in using your UAN.

- Step 3: Click on the ‘Online Services’ dropdown and select ‘Claim (Form-31, 19, 10C)’.

- Step 4: Choose the appropriate form based on your withdrawal type and fill in the required details.

- Step 5: Submit the application and note the claim reference number for tracking.

Processing Time and Tracking

Once submitted, EPFO usually processes claims within 3-7 working days, though it can take longer during peak seasons. Applicants can track the status of their claim through the EPFO portal or via SMS updates.

Conclusion

Understanding the PF withdrawal process is crucial for employees in India, especially in an evolving job market. With digitization, the process has become more efficient, yet awareness of eligibility and proper documentation remains essential for a smooth withdrawal experience. As the workforce continues to adapt to changing employment scenarios, timely access to PF savings can greatly assist individuals in their financial journey.