Understanding the NSE Pre Open Market and Its Importance

Introduction

The NSE Pre Open Market is a crucial phase in the trading calendar of the National Stock Exchange (NSE) of India. This period allows traders and investors to gauge market direction and sentiment before the regular trading session commences. Understanding the dynamics of the pre-open market can guide investors in making informed trading decisions, making it a topic of great relevance in today’s financial landscape.

The Pre Open Market Phase

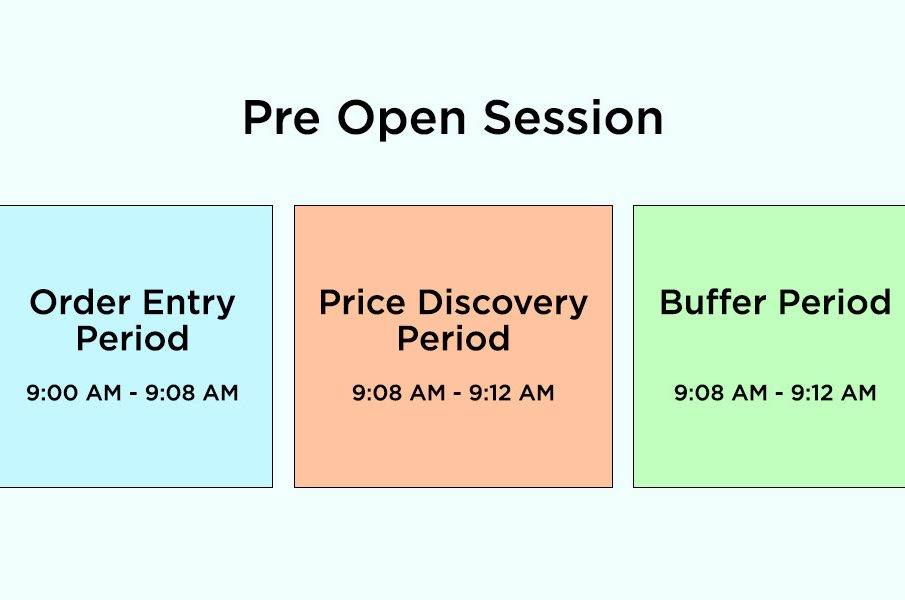

The pre-open phase generally lasts for 15 minutes starting at 9:00 AM until 9:15 AM IST. It is designed to enable market participants to adjust their orders based on overnight news, global cues, or any other economic indicators that could impact stock prices. During this period, orders can be placed but not executed. The prices discovered through this session set the stage for the opening prices in the regular session.

Order Matching and Price Discovery

In this phase, various orders such as limit orders, market orders, and stop-loss orders can be placed. The NSE uses a unique mechanism that involves the aggregation of all orders received during this period to determine a single equilibrium price based on supply and demand. This price reflects the collective sentiment of market participants, offering a more comprehensive view than individual trades might provide.

Recent Developments and Market Trends

As of October 2023, the NSE has seen fluctuations resulting from various factors including geopolitical events, interest rate changes, and shifts in global markets. For instance, the recent increase in interest rates by the Reserve Bank of India has led to a cautious sentiment in the pre-open phase, affecting trading strategies as investors reassess risk versus return.

Conclusion

In conclusion, the NSE Pre Open Market serves as a vital indicator for traders and investors looking to understand market trends and make educated trading decisions. With the ongoing volatility in global markets, leveraging the insights gained during the pre-open phase can offer an edge. Observing the trends and orders in this session can reveal potential opportunities or risks, ultimately informing more strategic investment approaches in the evolving financial landscape.