Understanding the NSE Pre Open Market

Introduction

The National Stock Exchange (NSE) pre-open market is a crucial phase in the trading session where investors can place orders before the market officially opens. This period is significant as it allows traders and investors to gauge market sentiment and make informed decisions based on global cues, economic data, and corporate announcements. Understanding the dynamics of the pre-open market is essential for anyone looking to invest in the stock market, as it sets the tone for the day’s trading.

What is the NSE Pre Open Market?

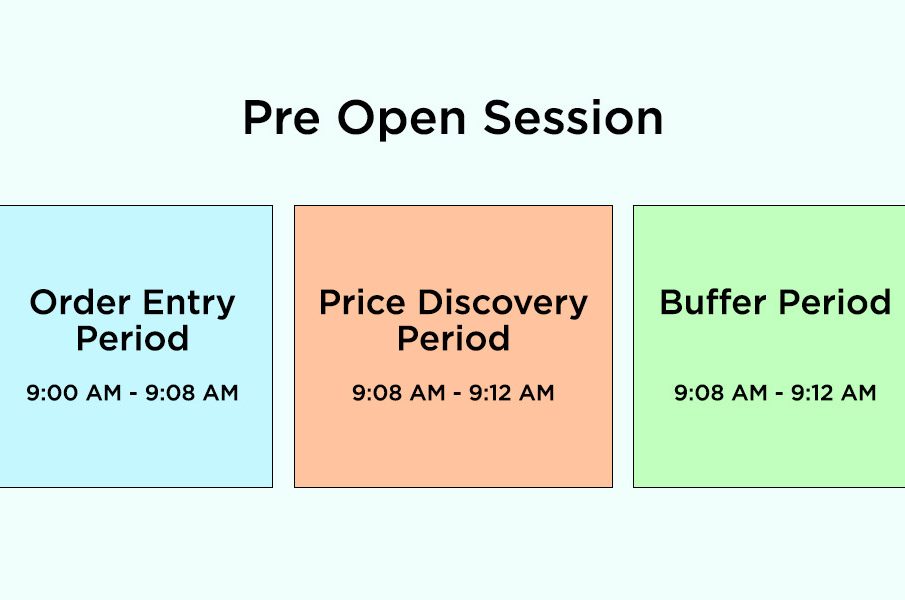

The pre-open market period typically lasts for 15 minutes before the regular market opens, from 9:00 AM to 9:15 AM IST. During this time, participants can place orders, but no trades are executed until the bidding process concludes. Orders received during this period are matched based on equilibrium price, which is determined by supply and demand. The pre-open session helps in minimizing volatility during the opening of the market.

Current Trends and Events

As of October 2023, the pre-open market has gained additional relevance due to recent economic reforms and global market trends. For example, with inflation rates fluctuating globally and concerns around geopolitical tensions, traders are keenly watching the pre-open market indicators to adjust their strategies. Recent data released by the Reserve Bank of India has also influenced investor sentiment, leading to a more cautious approach during the pre-open phase. Analysts suggest keeping an eye on sectors like technology and pharmaceuticals that could react strongly to upcoming earnings reports.

Conclusion

In conclusion, the NSE pre-open market serves as a vital launchpad for investors and traders within the Indian stock market. By paying attention to the indicators and sentiments during this phase, one can make more informed trading decisions throughout the day. As we move forward, understanding the capabilities and functions of the pre-open session will be increasingly important, especially in times of market volatility. Investors are encouraged to utilize this period not only to align their strategies in accordance with market trends but also to enhance their overall trading performance.